TAX CODE — SLCIR

What is Tax Code SLCIR?

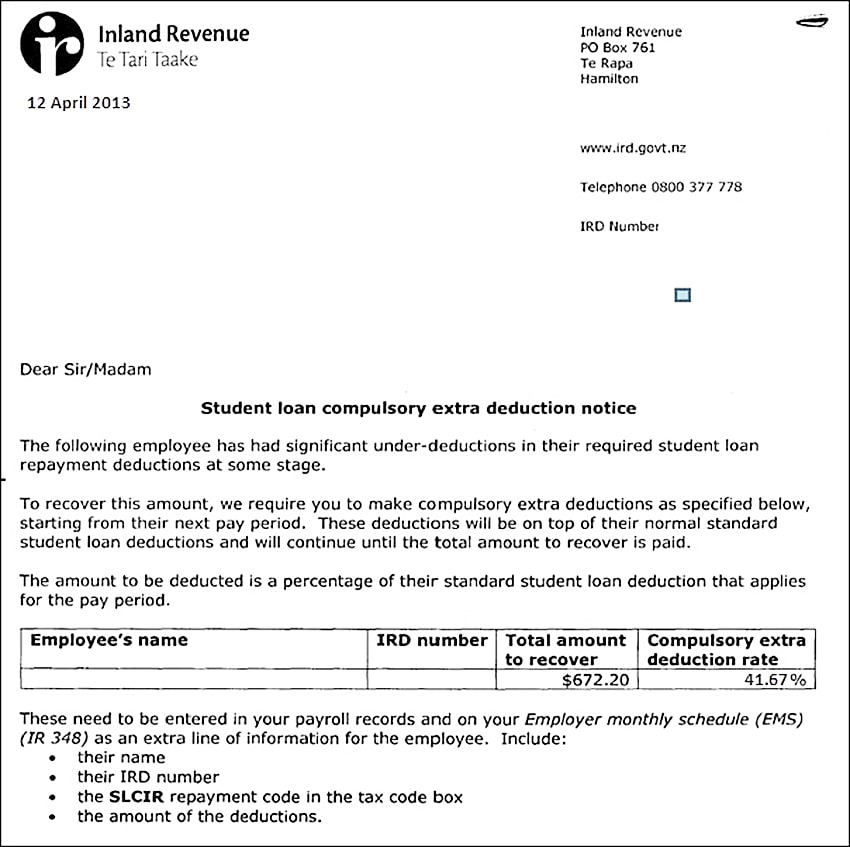

If you have employees with a student loan then you most possibly have come across a letter from Inland Revenue about student loan repayment rate.

Follow these instructions to process the change in Your Payroll.

Letter sample:

⇨ The Compulsory Extra Deduction Rate given on the notice (41.67% in the above example) is relative to the standard student loan repayment rate, not relative to the employee's full wage.

How To Calculate The Rate For Your PayrollTo calculate the rate to be entered into Your Payroll, multiply the compulsory extra deduction rate as provided on the IRD letter by the standard student loan repayment rate.

If the standard student loan repayment rate from 1st April 2013 is 12%, so the calculation is as follows:

If the Compulsory extra deduction rate on the letter is 41.67%, multiply this by 12%, i.e, 41.67% ╳ 12% = 5 |

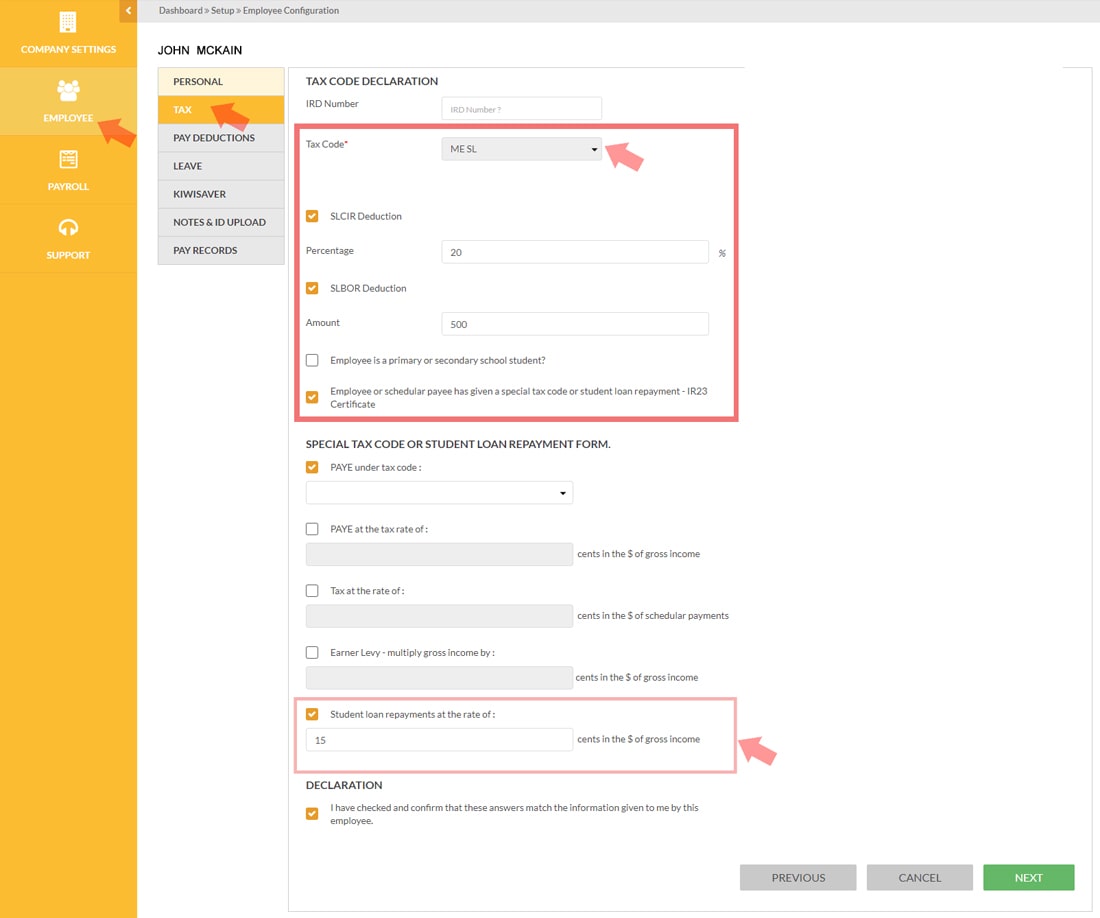

How To Enter The Rate On Your Payroll

1. In Your Payroll, login and go to your Dashboard

2. Click Employees tab on the left.

3. Select an employee from the list.

4. Click the Tax tab below the Personal tab.

5. Select a Tax Code from the drop-down list.

6. Pick a relevant option and enter the details.

7. For SLCIR, enter the deduction amount. This is the total amount to recover as advised on the IRD letter.

Screengrab sample:

8. Click NEXT / SAVE.

Keep in mind:

While SLCIR is compulsory, SLBOR is entirely voluntary. |

The deduction will now appear on the IR345.

The extra deduction will cease once the total amount has been paid.

Click A Tax Code To Proceed

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Keeping track of my employees' payroll used to take me hours, days even, now, I do it in minutes.

– R. Burt