Secondary Tax Codes — ST & ST SL

What Are Tax Codes 'ST & ST SL'?

Use the ST tax code if your employee's annual income from ALL jobs is more than NZ$ 70,000, and has NO student loan.

Use ST SL if the employee has a student loan.

|

Example: Joe, a designer, makes NZ$ 80,000 per year. But he also has a second job where he rakes in another NZ$ 6,000. His total annual income is now NZ$ 86,000. He has no student loan. Here, his higher income uses a primary tax code and the lower source uses the ST tax code. |

NOTE: Rate of the secondary tax depends on the total amount of income from ALL jobs.

If your employee is under the wrong tax code, they're going to end up with a big tax bill at the end of the year. Ensure that your workers notify you whenever their circumstances change.

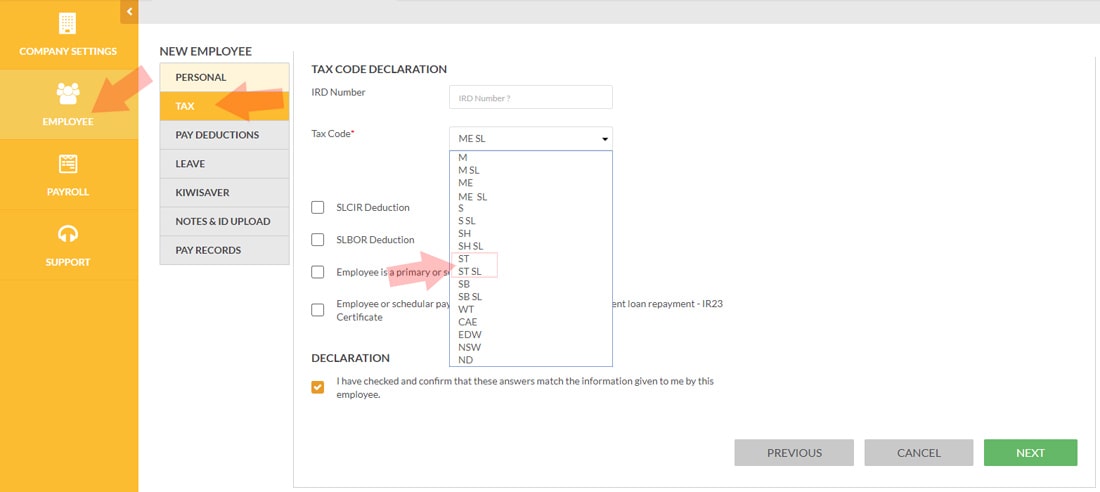

Where to Find & Enter Tax Code 'ST or ST SL'?

1. After logging in, go to your Dashboard

2. Click Employees tab on the left.

3. Select an employee from the list.

4. Click the Tax tab below the Personal tab.

5. Select Tax Code ST or ST SL from the drop-down list.

Screengrab sample:

Click A Tax Code To Proceed

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Keeping track of my employees' payroll used to take me hours, days even, now, I do it in minutes.

– R. Burt