Tax Code — NSW

What Is Tax Code 'NSW'?

| Note: This tax code only applies to temporary, casual and seasonal workers, so you can skip this if you want. |

Basically, the NSW tax code is for seasonal workers who work seasonally in the horticulture or viticulture industries and are employed by a registered New Zealand employer under the Department of Recognised Seasonal Employers’ Scheme.

These could also be foreign fishing workers who hold a work visa as a foreign crew of a vessel fishing New Zealand waters.

These workers are non-residents for New Zealand tax purposes but have to pay New Zealand tax on their New Zealand income.

Workers here are taxed through the PAYE system at a flat rate. They may also have to make deductions for child support payments. However, they won't have student loan deductions or be eligible to join KiwiSaver.

|

Remember: Employees under this code MUST HAVE a Recognised Seasonal Employer Limited Visa or Permit. |

If your employee is under the wrong tax code, they're going to end up with a big tax bill at the end of the year. Ensure that your workers notify you whenever their circumstances change.

Employment under NSW:

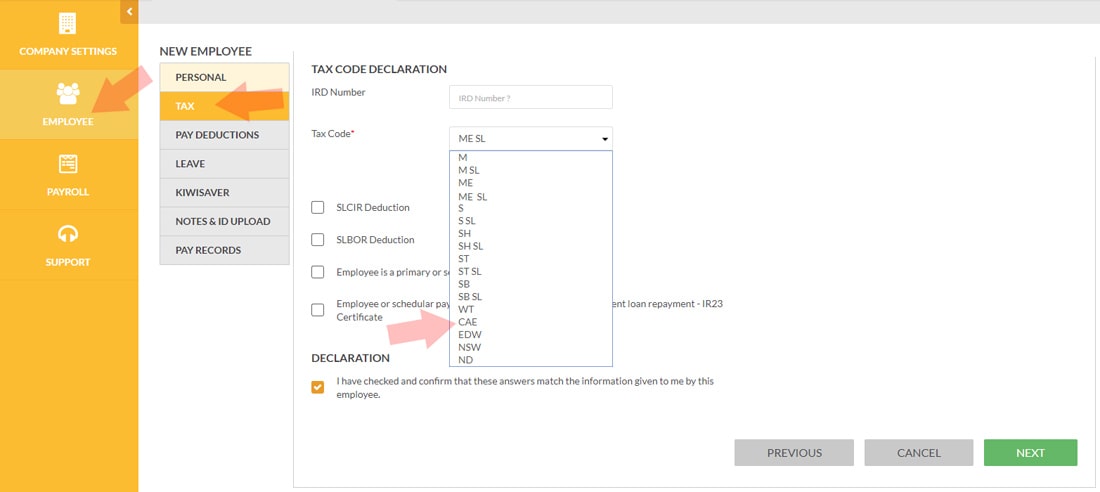

Where to Find & Enter Tax Code 'NSW'?

1. After logging in, go to your Dashboard

2. Click Employees tab on the left.

3. Select an employee from the list.

4. Click the Tax tab below the Personal tab.

5. Select Tax Code NSW from the drop-down list.

Screengrab sample:

Click A Tax Code To Proceed

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Keeping track of my employees' payroll used to take me hours, days even, now, I do it in minutes.

– R. Burt