Secondary Tax Codes— 'SB & SB SL'

What Are Tax Code 'SB & SB SL'?

If any of your employees have more than one job, then their tax code can get a little complex too with a Secondary Tax Code.

Use an SB tax code if the annual income from ALL jobs is less than NZ$ 14,000 but WITHOUT a student loan.

Use SB SL if the employee has a student loan.

|

Example: Peter recently graduated from high school and is working part-time at his aunt’s diner. He earns NZ$ 4,000 annually. He also works at his sister’s cafe making NZ$ 6,000 annually. Naturally, his total annual income is NZ$ 10,000. He has no student loans. In this case, the higher income source uses a primary tax code, and the lower source uses SB tax code. |

NOTE: Rate of the secondary tax depends on the total amount of income from ALL jobs.

If your employee is under the wrong tax code, they're going to end up with a big tax bill at the end of the year. Ensure that your workers notify you whenever their circumstances change.

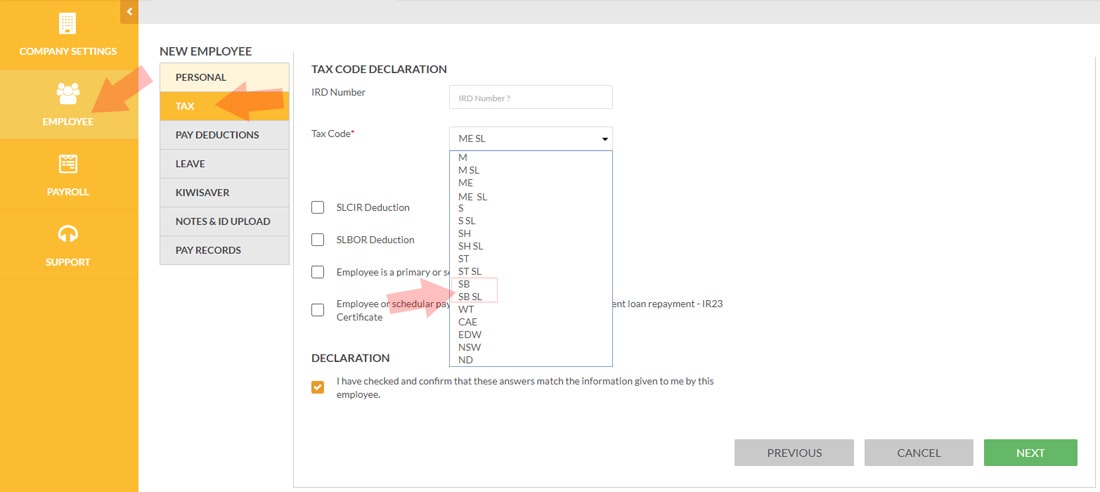

Where to Find & Enter Tax Code 'SB or SB SL'?

1. After logging in, go to your Dashboard

2. Click Employees tab on the left.

3. Select an employee from the list.

4. Click the Tax tab below the Personal tab.

5. Select Tax Code SB or SB SL from the drop-down list.

Screengrab sample:

Click A Tax Code To Proceed

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Keeping track of my employees' payroll used to take me hours, days even, now, I do it in minutes.

– R. Burt