Secondary Tax Code — CAE

What Is Tax Code 'CAE'?

| Note: This tax code only applies to temporary, casual and seasonal workers, so you can skip this if you want. |

Workers under this tax code are generally under a type of fixed-term employment where the employment agreement says that the work will finish at the end of the season. In some situations, seasonal employment can become a rolling fixed-term employment in which the employee is re-hired at the start of every season.

CAE (Casual Agricultural Employee) includes shearers or shed hands engaged in casual seasonal work on a day-to-day basis, for up to 3-months (some shearers get as much as 10 months of employment a year).

These workers are taxed through the PAYE system at a flat rate.

|

Remember: Everyone you employ under CAE Tax Code needs a strict and updated written employment agreement. |

If your employee is under the wrong tax code, they're going to end up with a big tax bill at the end of the year. Ensure that your workers notify you whenever their circumstances change.

Employment under CAE:

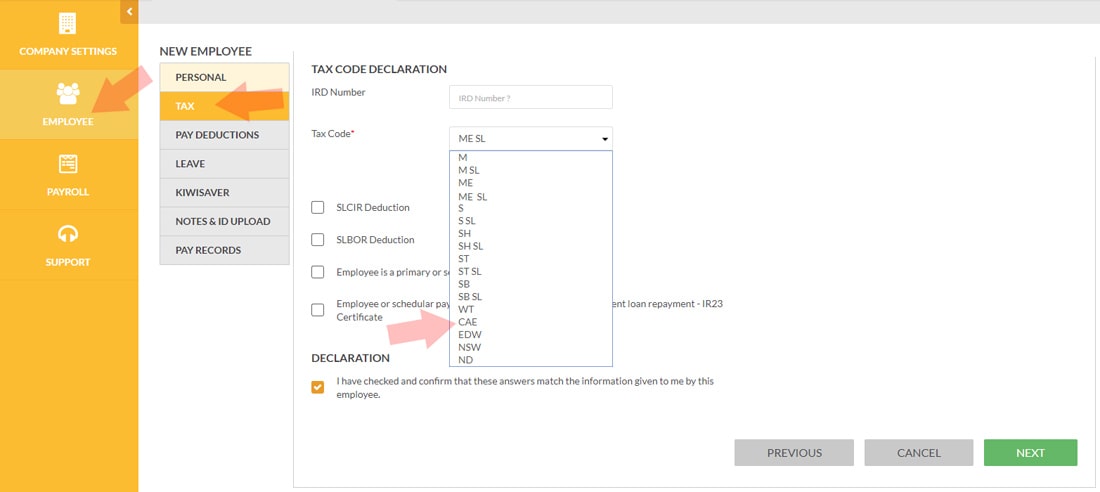

Where to Find & Enter Tax Code 'CAE'?

1. After logging in, go to your Dashboard

2. Click Employees tab on the left.

3. Select an employee from the list.

4. Click the Tax tab below the Personal tab.

5. Select Tax Code CAE from the drop-down list.

Screengrab sample:

Click A Tax Code To Proceed

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Keeping track of my employees' payroll used to take me hours, days even, now, I do it in minutes.

– R. Burt