Tax Code — ND

What Is Tax Code 'ND'?

ND is a non-declaration (also known as a no-notification tax rate). This means the employee did not give you a completed Tax code declaration (IR330) and is being charged at a rate of 45%, or, a contractor receiving schedular payments did not give you a completed Tax rate notification for contractors (IR330C).

For people receiving schedular payments, the no-notification rate is 45 cents in the dollar unless they are a non-resident contractor company or a non-resident entertainer in which case the rate is 20 cents in the dollar.

|

Remember: The rate for non-resident entertainers will always be 20% whether they've provided an IR330C or not. |

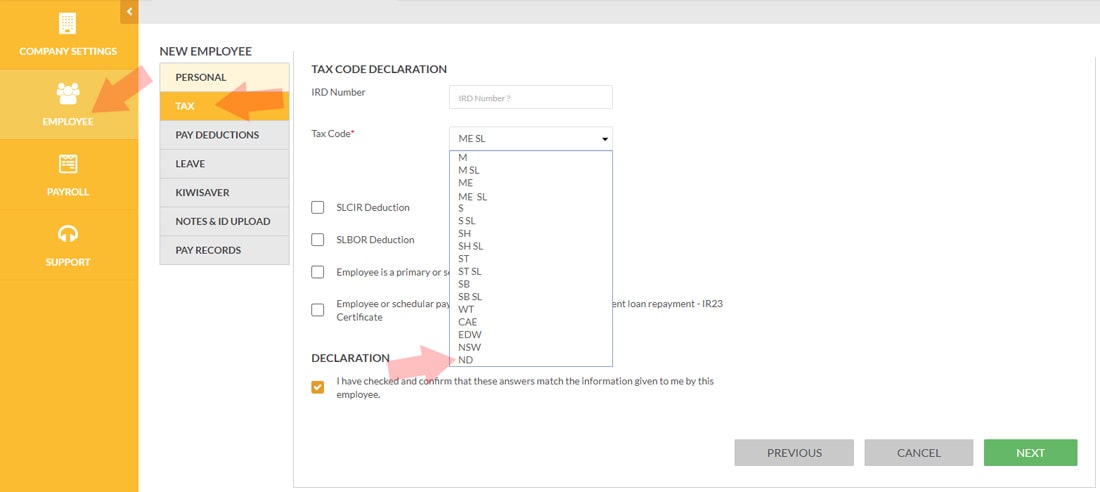

Where to Find & Enter Tax Code 'ND'?

1. After logging in, go to your Dashboard

2. Click Employees tab on the left.

3. Select an employee from the list.

4. Click the Tax tab below the Personal tab.

5. Select Tax Code ND from the drop-down list.

Screengrab sample:

Click A Tax Code To Proceed

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Keeping track of my employees' payroll used to take me hours, days even, now, I do it in minutes.

– R. Burt