How to Amend Pay Run

Q: When to amend pay run?

A: When you find errors in previous pay run history.

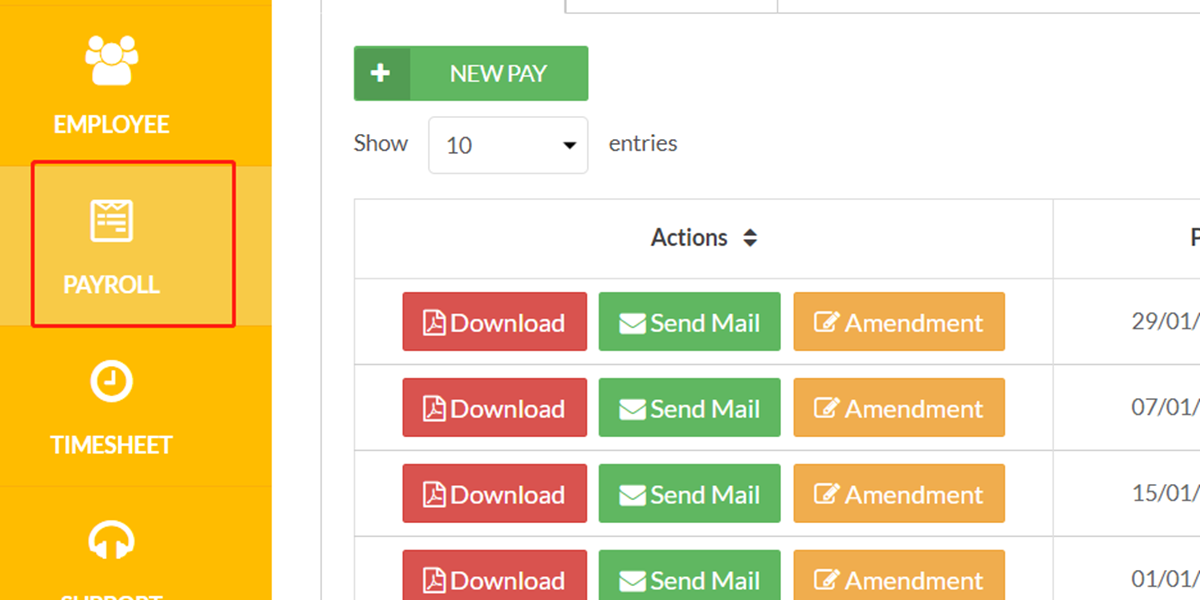

Step 1

Go to "Payroll" tab.

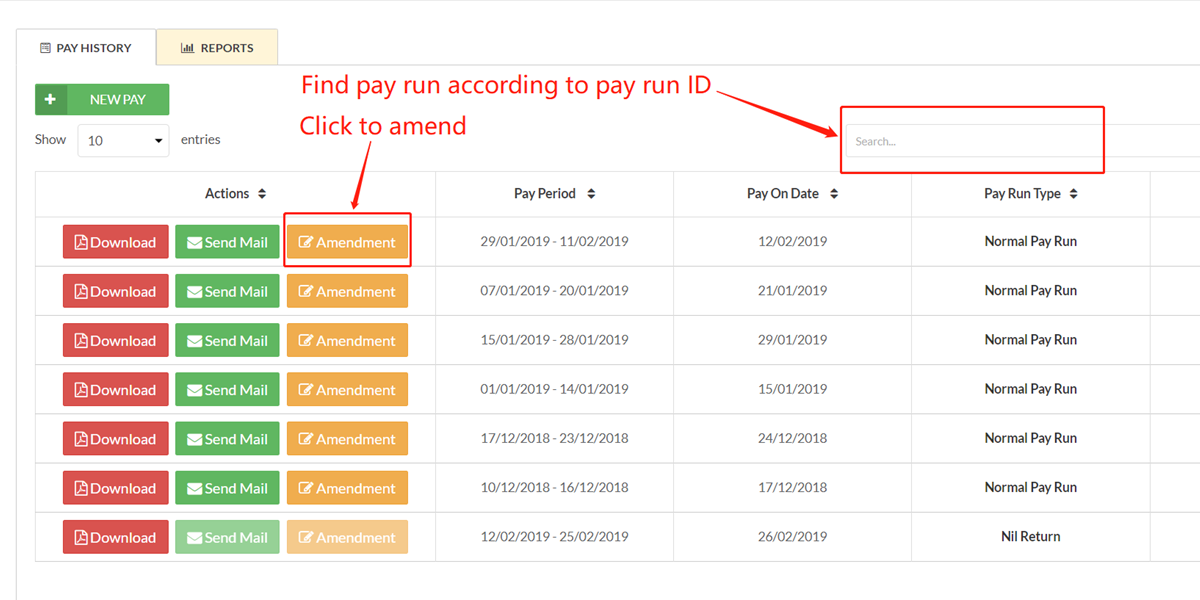

Step 2

Select the pay run that you would like to amend.

You can search pay run according to its ID.

Click “Amendment” button.

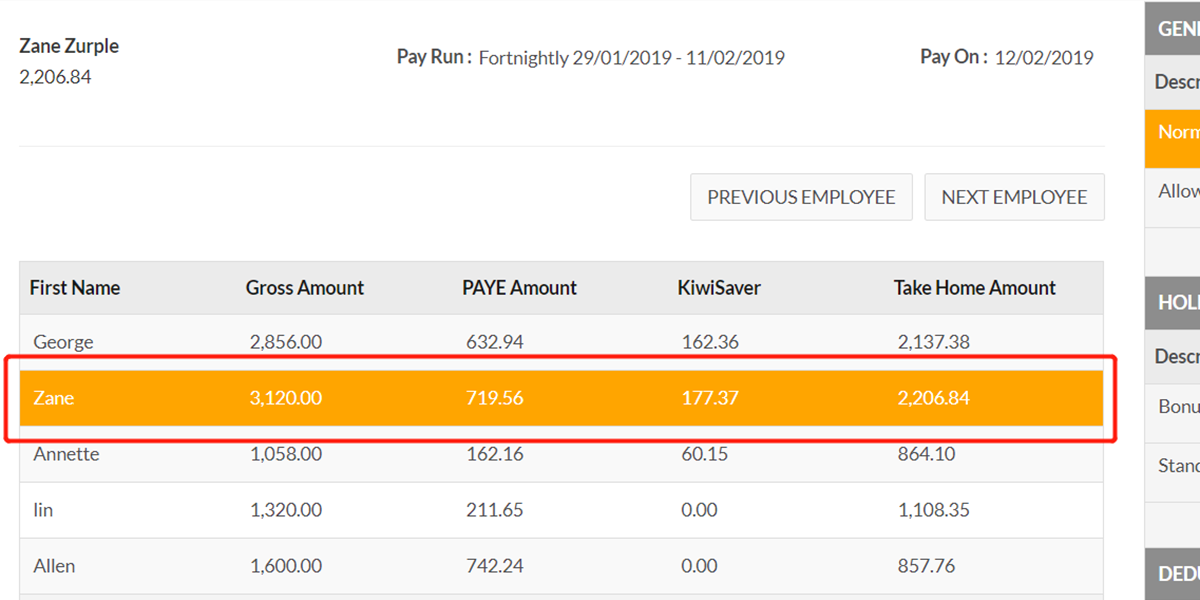

Step 3

Select the employee that you would like to amend.

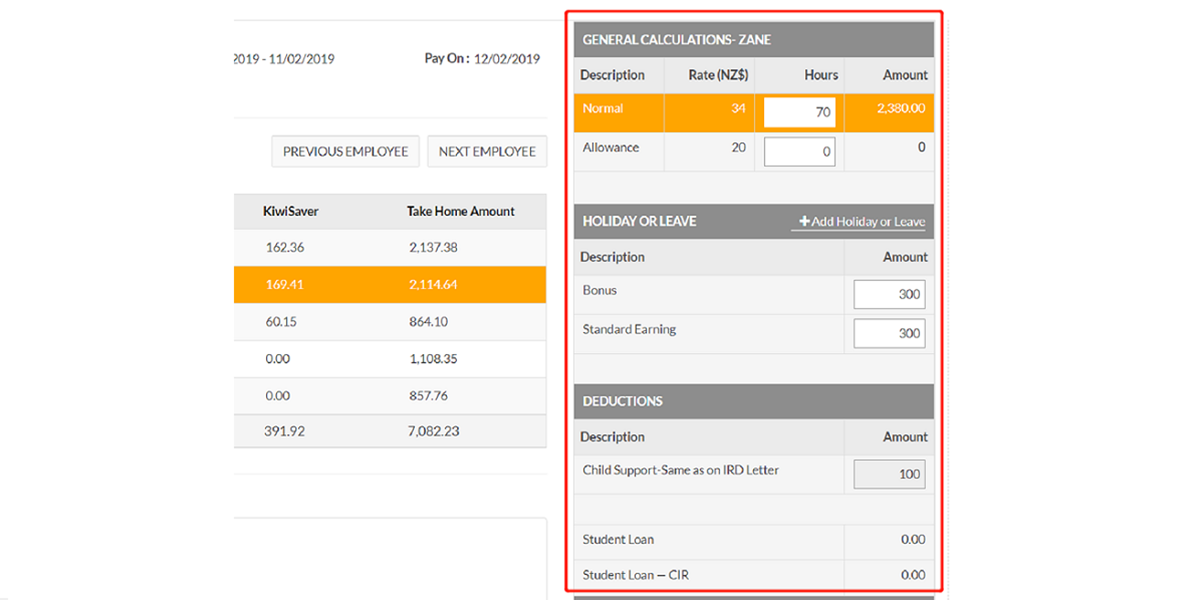

Step 4

Change the amounts in the calculation area.

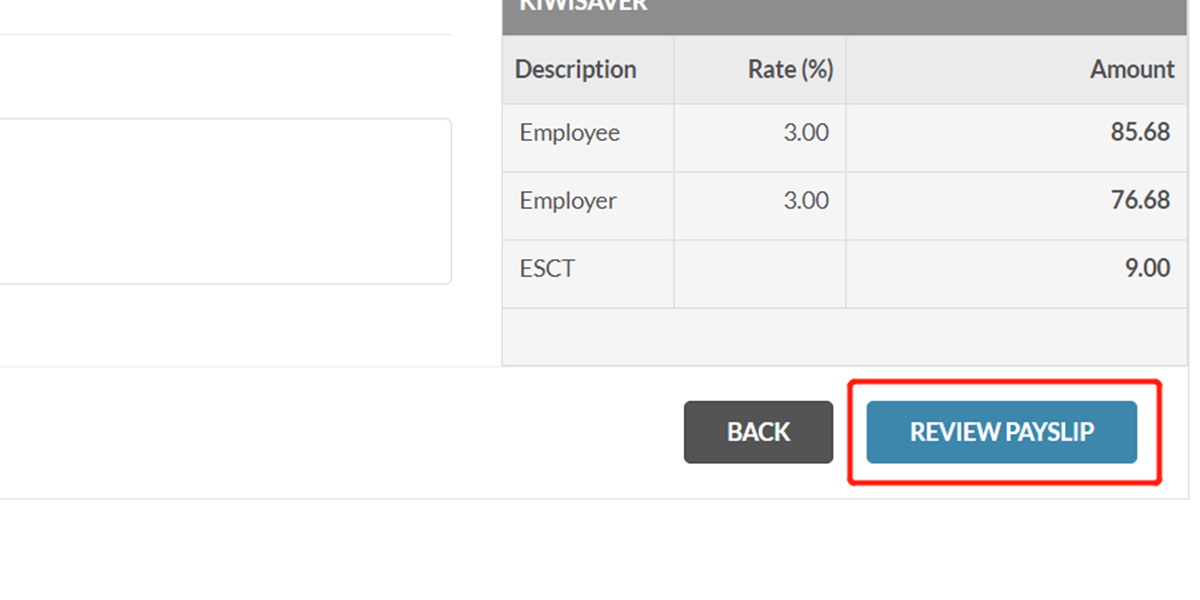

Step 5

Then click “Review Payslip”.

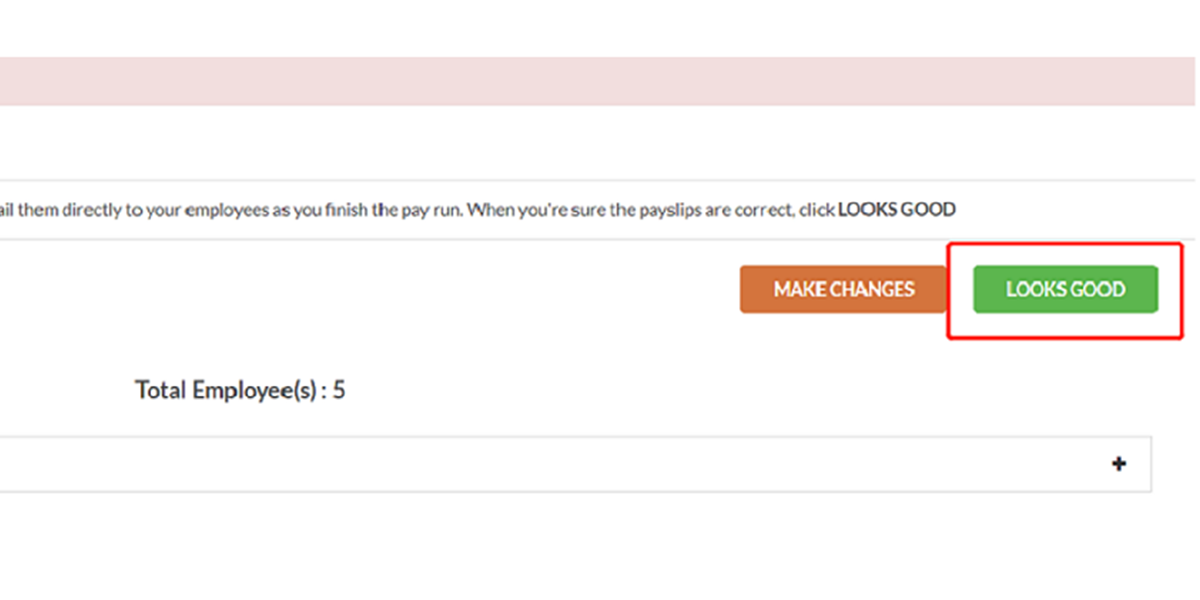

Step 6

After reviewing the payslips, click “Looks Good” button.

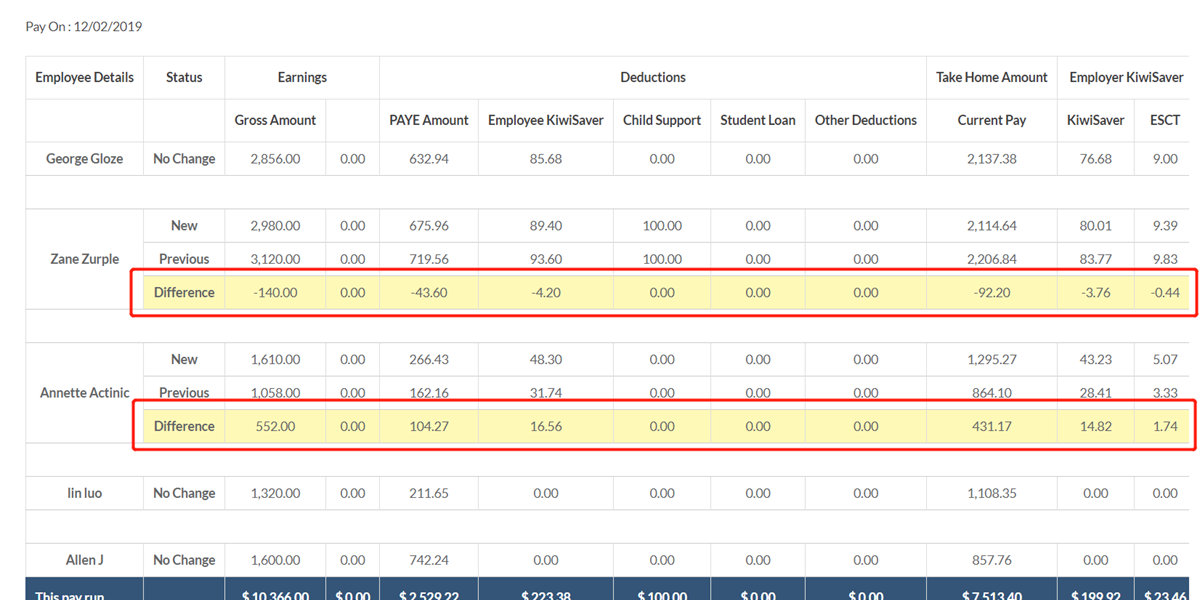

Step 7

The amended pay details will be highlighted.

Please review the highlighted areas before proceeding.

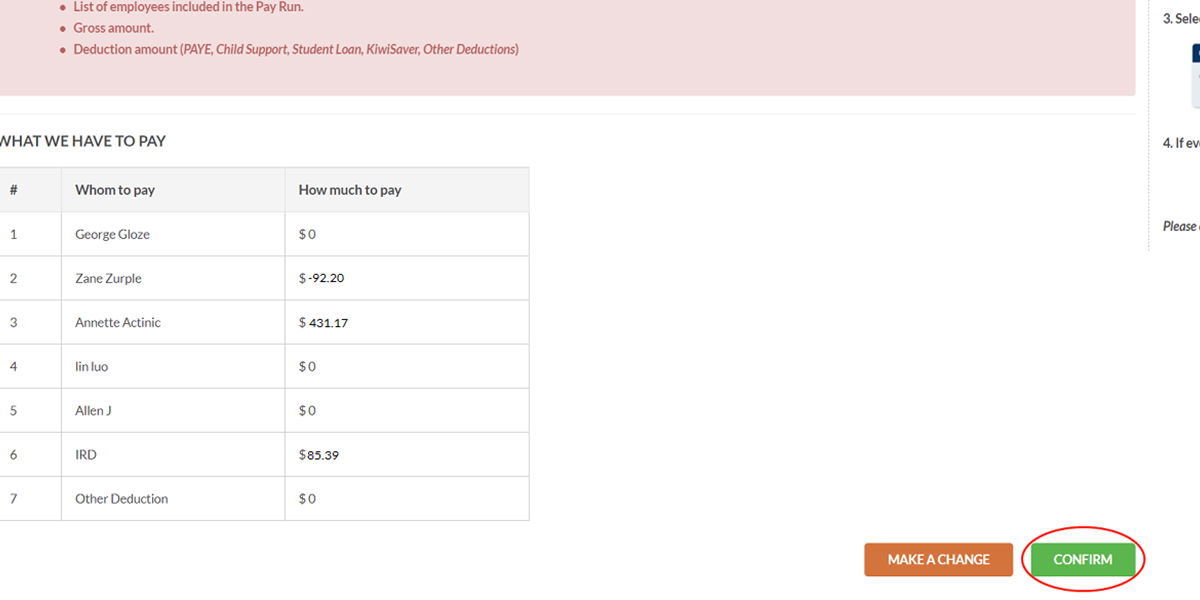

Step 8

If you would like to make a change, click the “Make a Change” button on the bottom right side of the page.

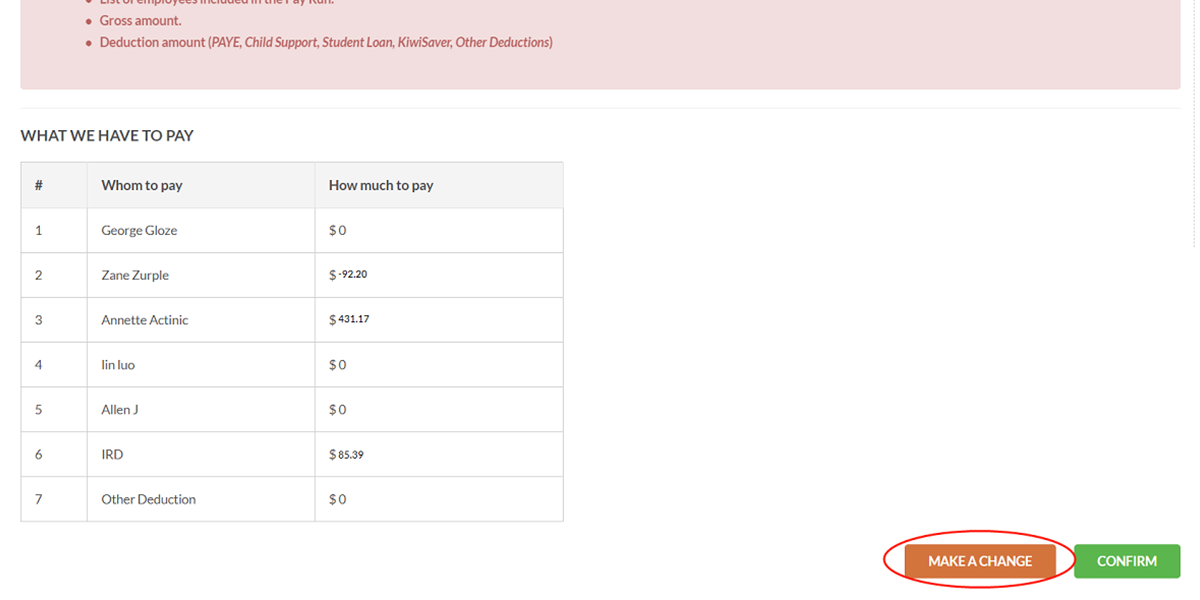

Step 9

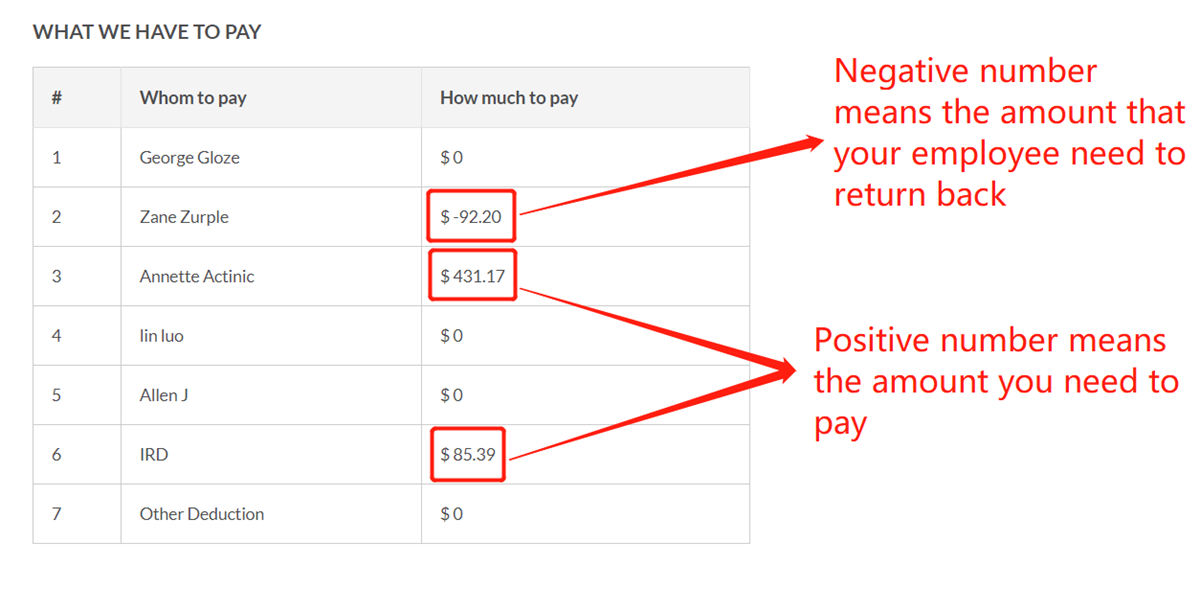

At the bottom, you can see the summary of how much to pay.

Negative number means the amount need to be returned from your employee.

Positive number means the amount need to be paid by you.

NOTE:

Please take a screenshot of this table.

You may need to refer to it when claiming refund from your employee or make payment to your employee.

You may also need these figures to pay the outstanding tax (e.g. PAYE, KiwiSaver etc.) to IRD. (Click to learn how to pay IRD manually)

Step 10

If everything looks good, please click "confirm" button.

Step 11

That's all, You've successfully done your amendment!