How to Set Up Employee | Deductions

Things to Know

-

If video learning is your style, please click on video and start to learn Set up Employee in Your Payroll (watch from 2' 50").

-

If step by step instruction is your style, then keep scrolling down.

Make sure you have following before start:

-

Employee's IRD Number;

-

Employee's Contact Details, including: mobile phone number and email;

-

Employee's Photo ID (Passport or NZ driver licence);

-

Tax Code Declaration Form: IR330 (For employee) ; IR330C (For contractor) ;

-

Student Loan Letter from IRD (if available).

Get Started

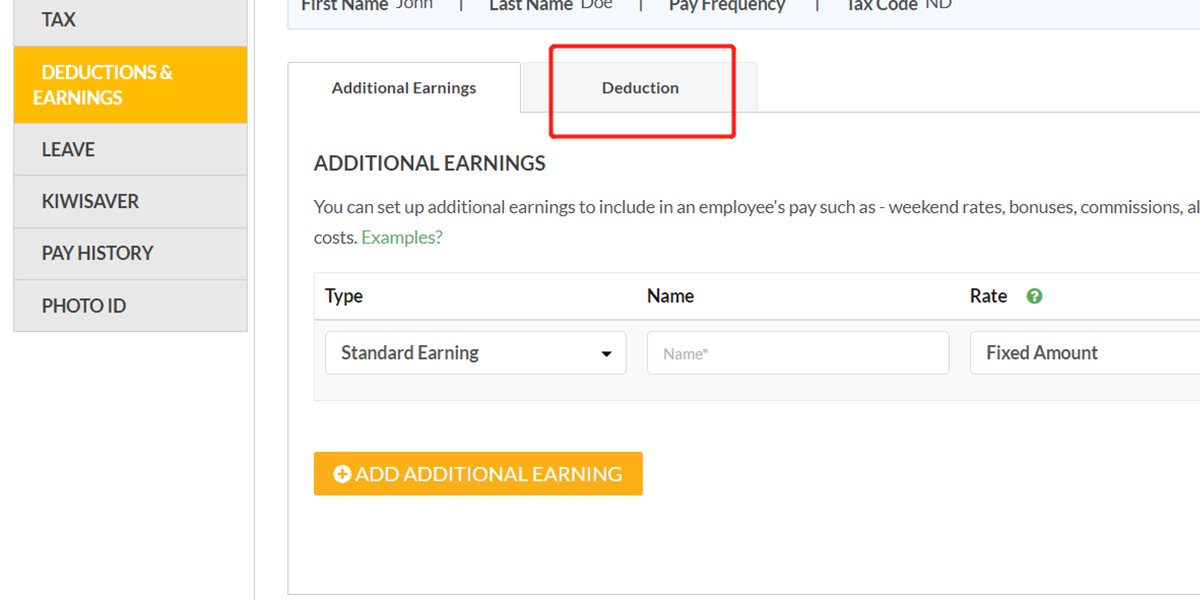

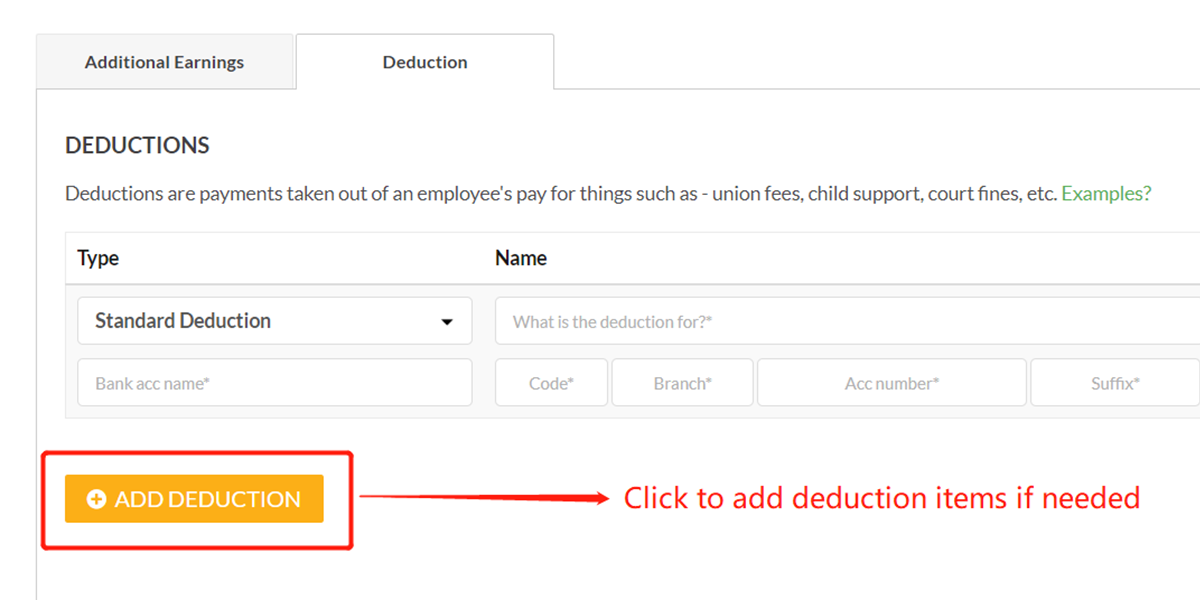

Click here to go to deduction tab.

Step 2

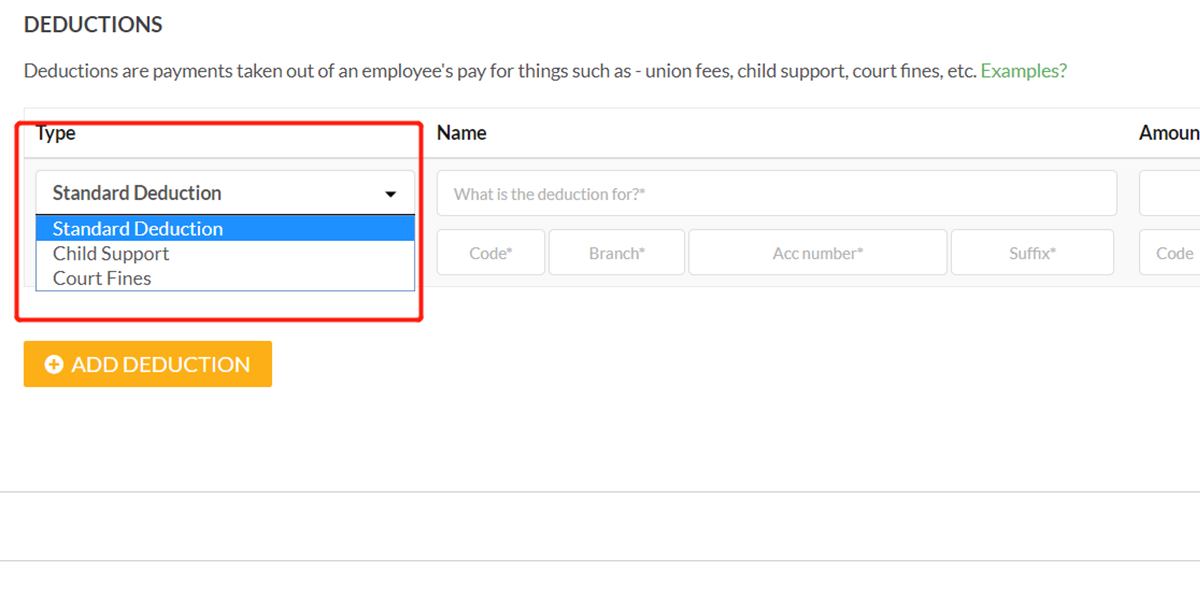

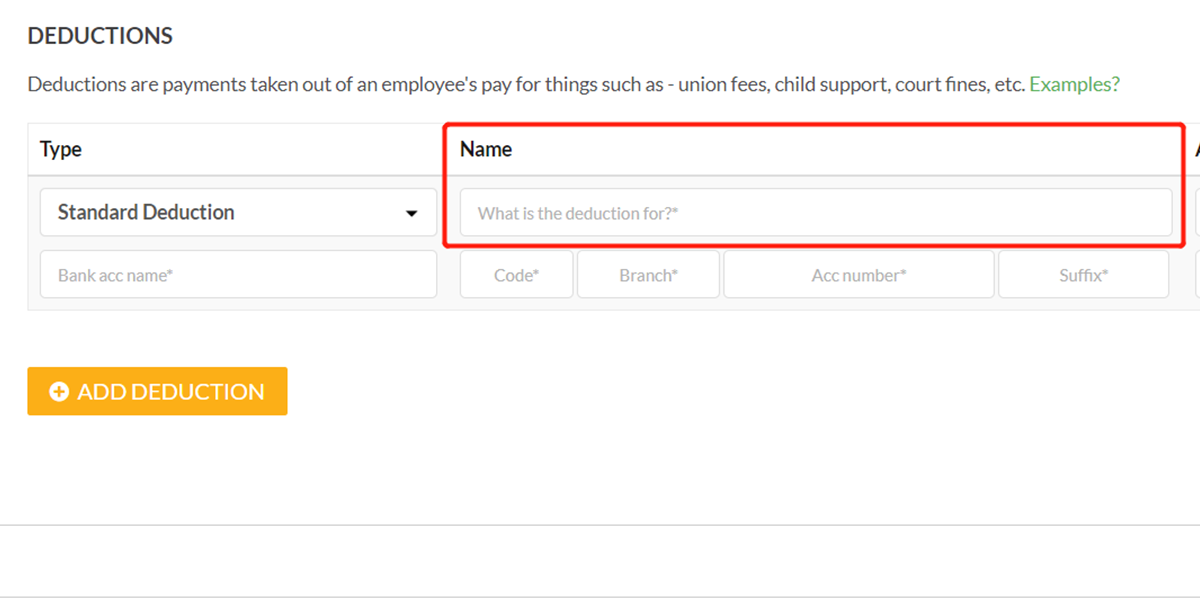

Select the type of deductions.

Step 3

Give it a name so that you can clearly identify it.

Step 4

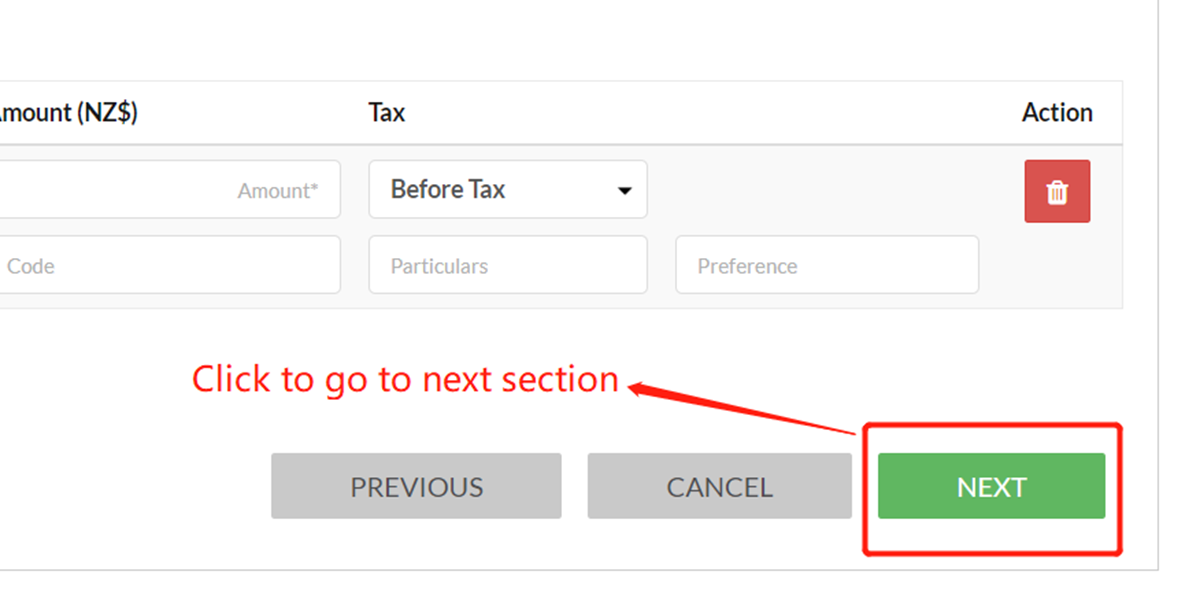

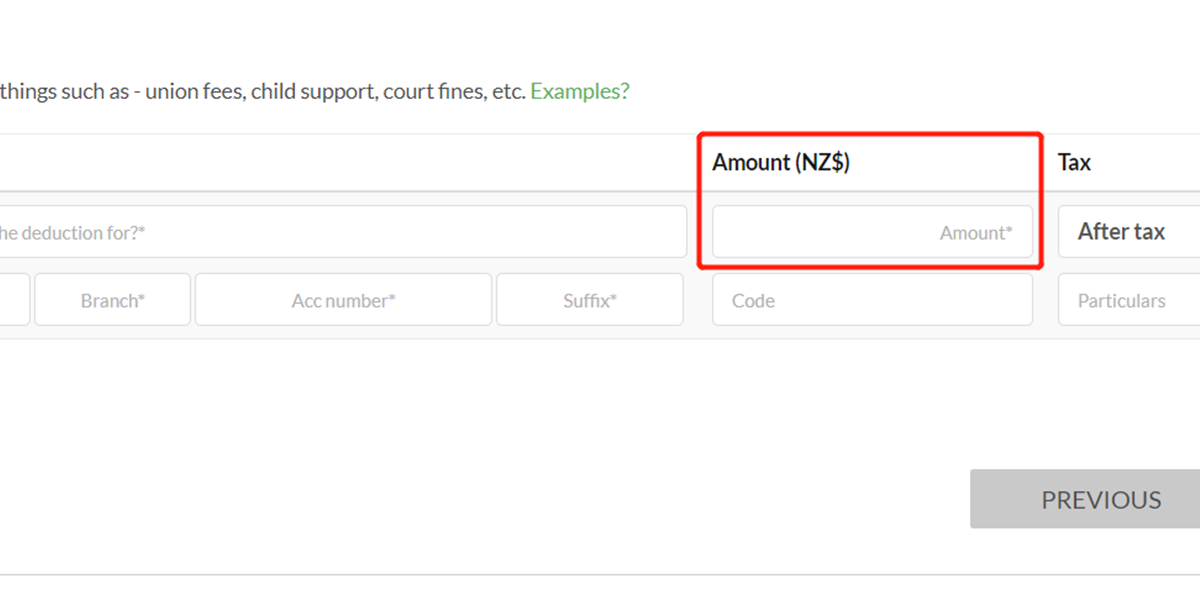

Input how much to deduct.

Step 5

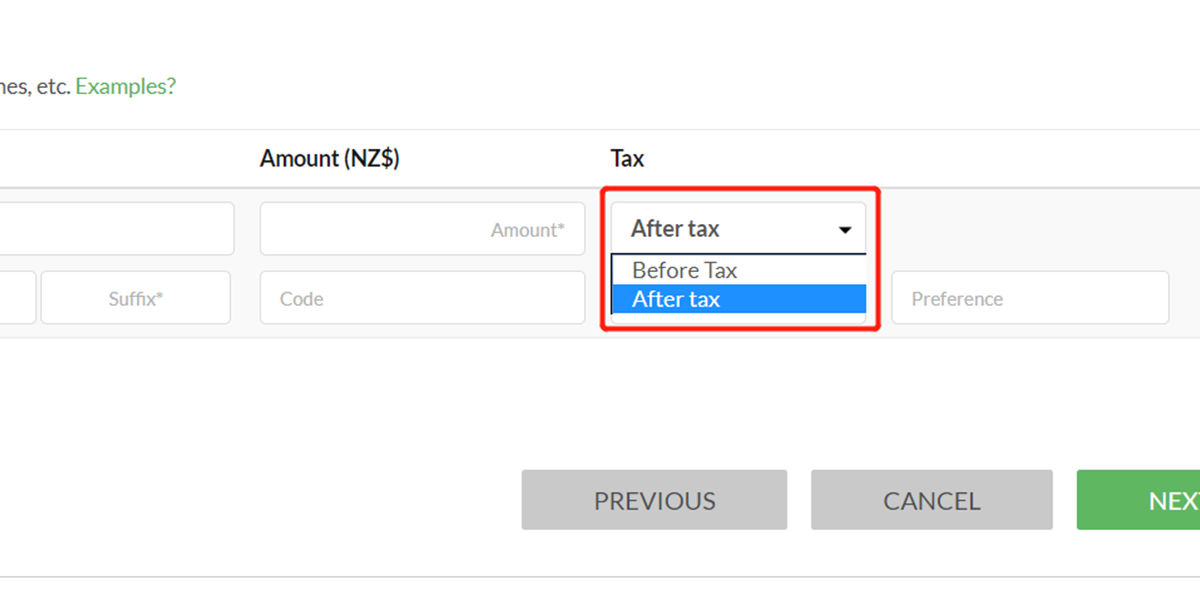

Select it’s either before tax or after tax.

Please be noted that child support and court fines are all AFTER TAX deductions according to IRD.

Step 6

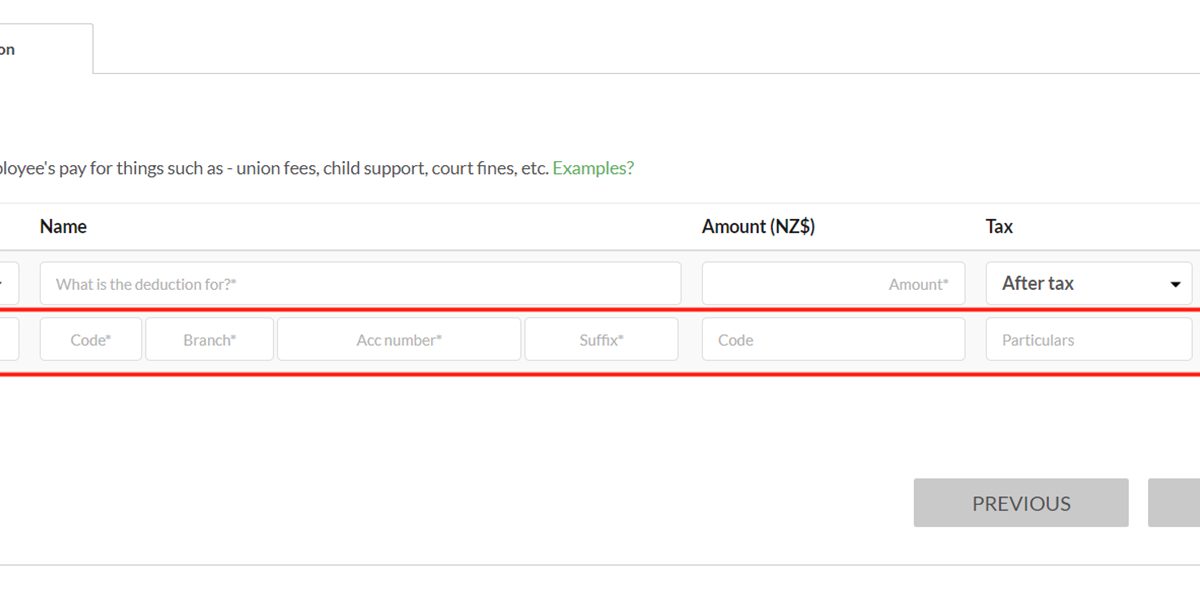

Input the bank account details that receives the deduction.

Step 7

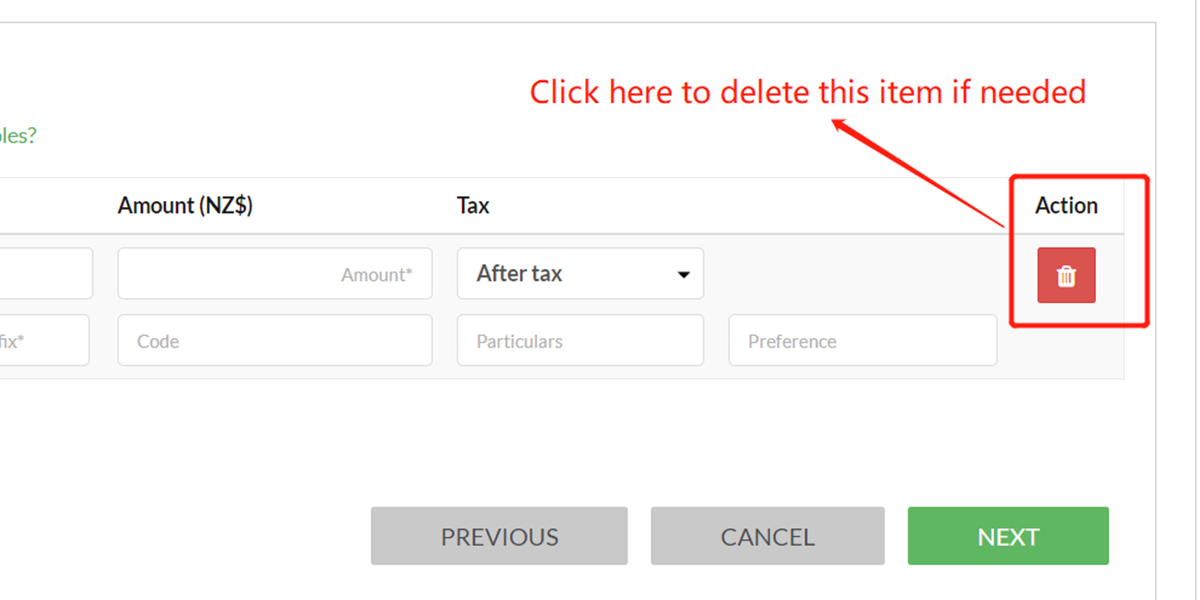

Click here to delete this item if you need.

Step 8

Click here to add more deductions if needed.