Primary Tax Code — 'ME'

What Is Tax Code 'ME'?

It's best to be a little more careful when using the ME tax code as it has some distinct differences from the M tax code. If unsure about which one to use, seek professional advice from one of our accountants. You can use an ME tax code if:

- They do not receive an income-tested benefit.

- This job is their main or highest source of income.

- They are New Zealand tax residents.

- Their annual income is likely to be between NZ$ 24,000 and NZ$ 48,000.

- They and their partner DO NOT receive Working for Families Tax Credit or an overseas equivalent.

- They DO NOT receive New Zealand Superannuation, veteran’s pension or an overseas equivalent.

- They DO NOT have a student loan.

|

Example: Lois works 40 hours a week with a total annual income of approximately NZ$ 39,000. Mary doesn’t have a partner and doesn’t receive any government support. She uses the ME tax code. |

NOTE: Only one primary tax code can be used.

If your employee is under the wrong tax code, they're going to end up with a big tax bill at the end of the year. Ensure that your workers notify you whenever their circumstances change.

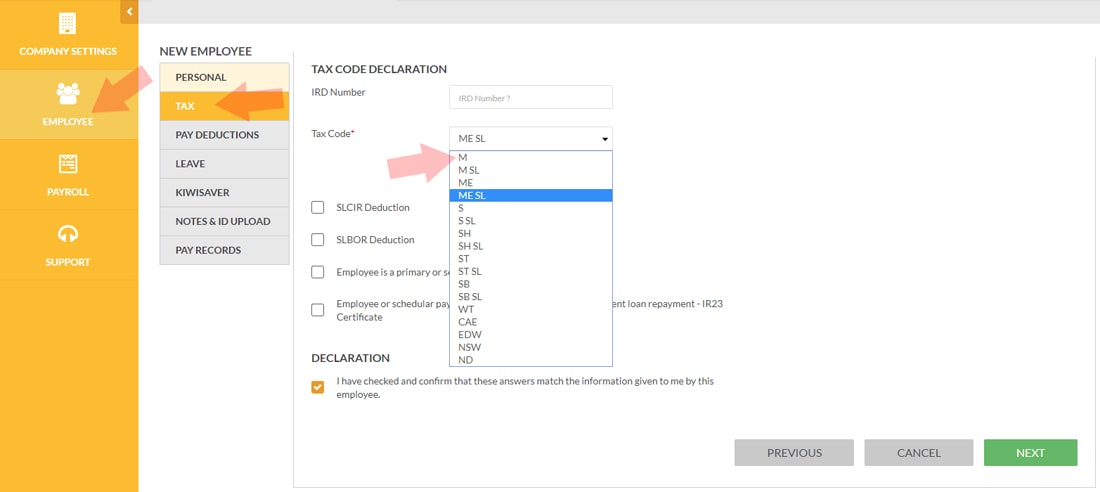

Where to Find & Enter Tax Code 'ME'?

1. After logging in, go to your Dashboard

2. Click Employees tab on the left.

3. Select an employee from the list.

4. Click the Tax tab below the Personal tab.

5. Select Tax Code ME from the drop-down list.

Screengrab sample:

Click A Tax Code To Proceed

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Keeping track of my employees' payroll used to take me hours, days even, now, I do it in minutes.

– R. Burt