How to Set Up Employee | Tax Tab

Things to Know

-

If video learning is your style, please click on video and start to learn Set up Employee in Your Payroll (watch from 0' 54").

-

If step by step instruction is your style, then keep scrolling down.

Make sure you have following before start:

-

Employee's IRD Number;

-

Employee's Contact Details, including: mobile phone number and email;

-

Employee's Photo ID (Passport or NZ driver licence);

-

Tax Code Declaration Form: IR330 (For employee) ; IR330C (For contractor) ;

-

Student Loan Letter from IRD (if available).

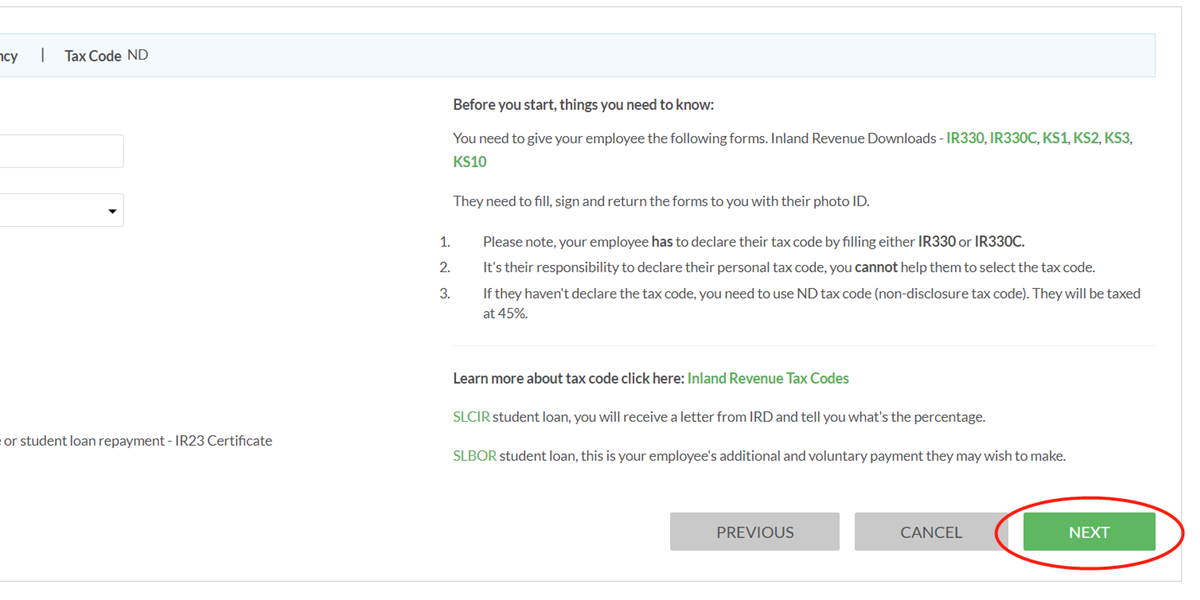

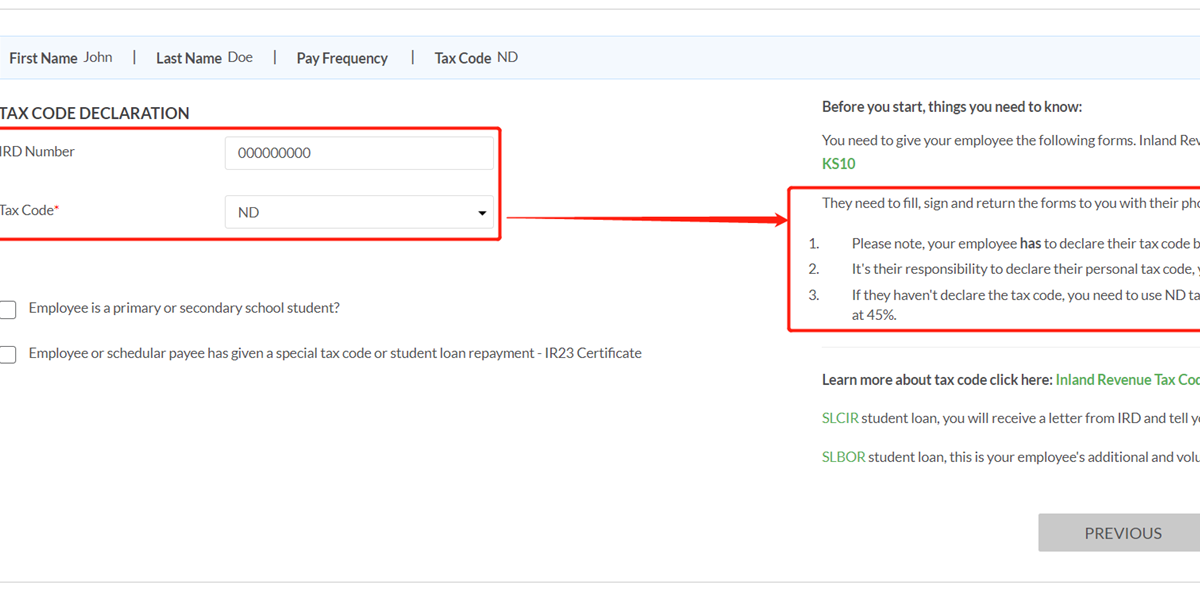

Get Started

Input employee's IRD number and tax code.

Ask the employee/contractor to complete and give you a Tax Code Declaration (IR330/IR330C) Form and KiwiSaver Forms (if available), which contain their tax information.

You can download these forms on the right side of the page.

Learn more about tax code

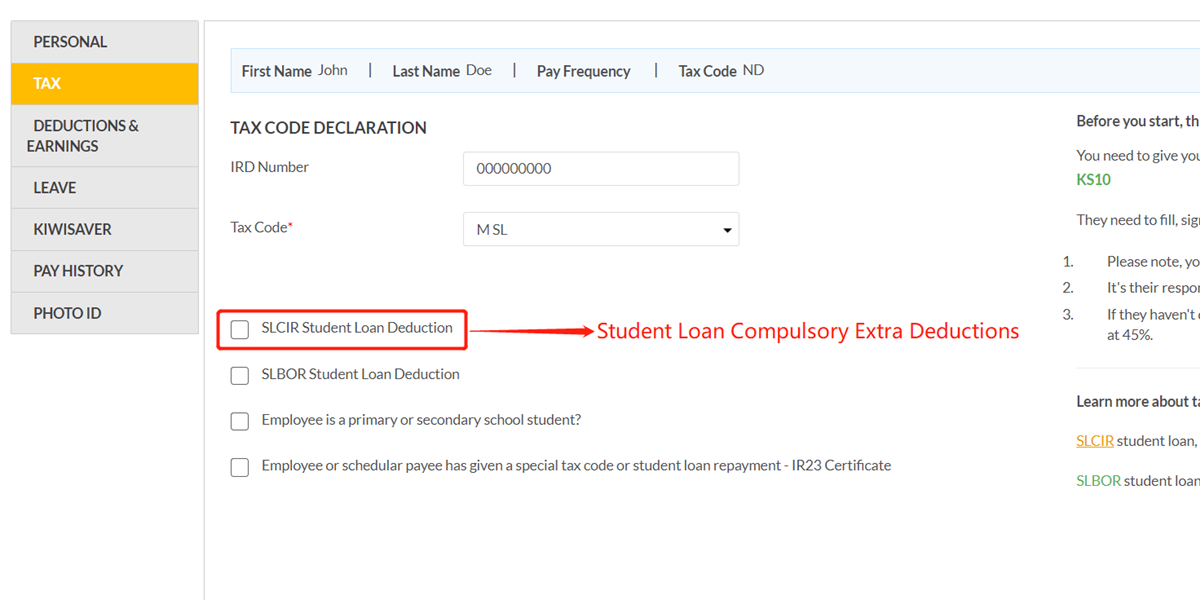

Step 2

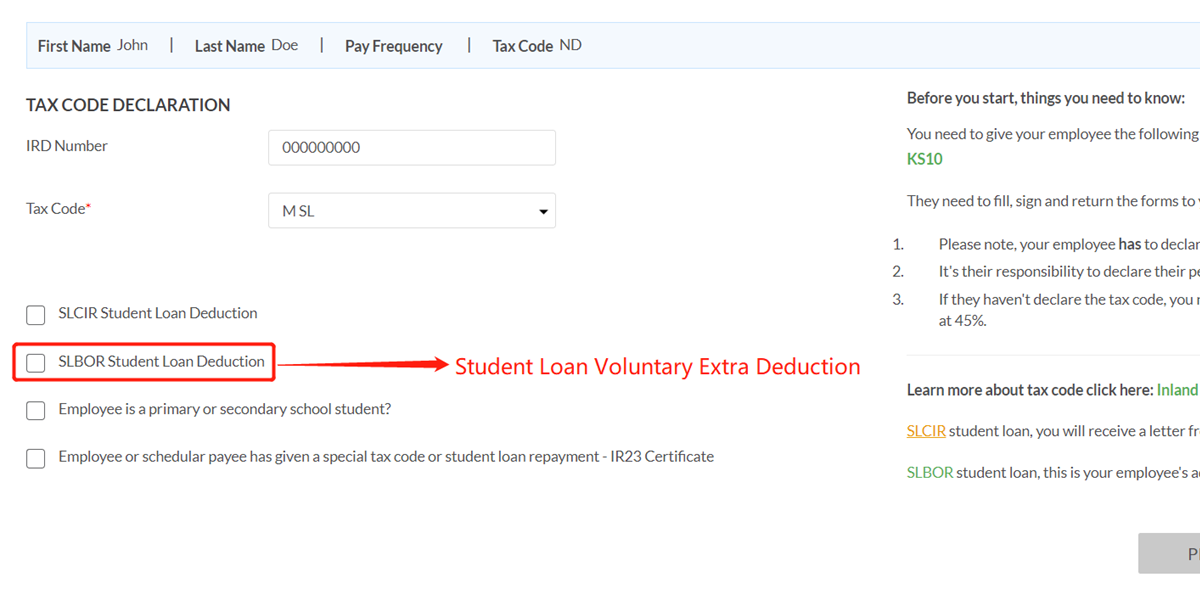

SLCIR is Student Loan Compulsory Extra Deductions .

Only click this box, if you have SLCIR letter from IRD. Click to see sample letter.

Step 3

SLBOR is Student Loan Voluntary Extra Deductions.

Only click this box, if your employee would like to make voluntary student loan deduction.

Please confirm the amount with him/her;

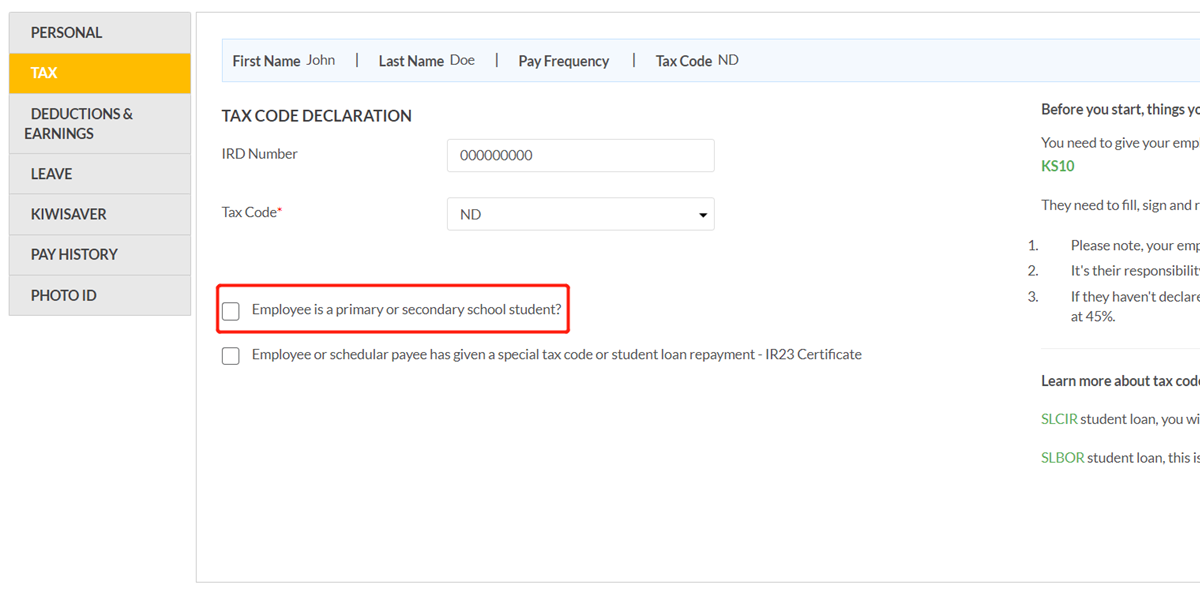

Step 4

Is your employee a primary or secondary school student?

If No, leave this box blank;

If Yes, check the box.

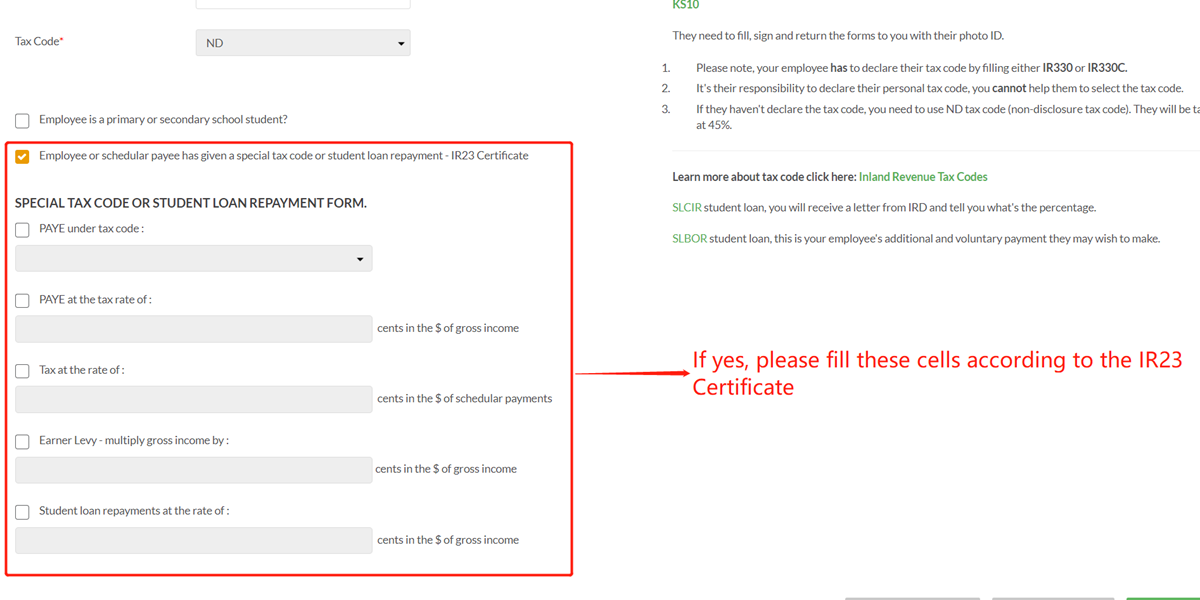

Step 5

Does your employee have a special tax code or student loan repayment

If No, leave this box blank;

If Yes, please fill these cells according to IR23 Certificate.