How to Set Up Employee | Personal Tab

Things to Know

-

If video learning is your style, please click on video and start to learn Set up Employee in Your Payroll (watch time 7' 05").

-

If step by step instruction is your style, then keep scrolling down.

Make sure you have following before start:

-

Employee's IRD Number;

-

Employee's Contact Details, including: mobile phone number and email;

-

Employee's Photo ID (Passport or NZ driver licence);

-

Tax Code Declaration Form: IR330 (For employee) ; IR330C (For contractor) ;

-

Student Loan Letter from IRD (if available).

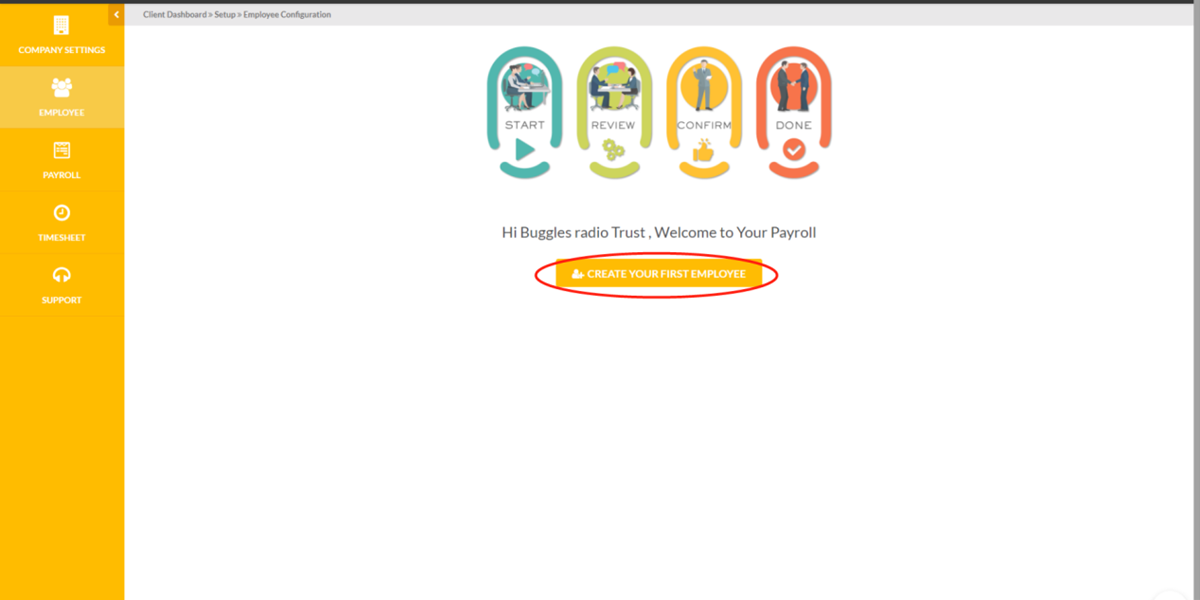

Get Started

First, go to employee page, then click “Create Your First Employee” button.

Step 2

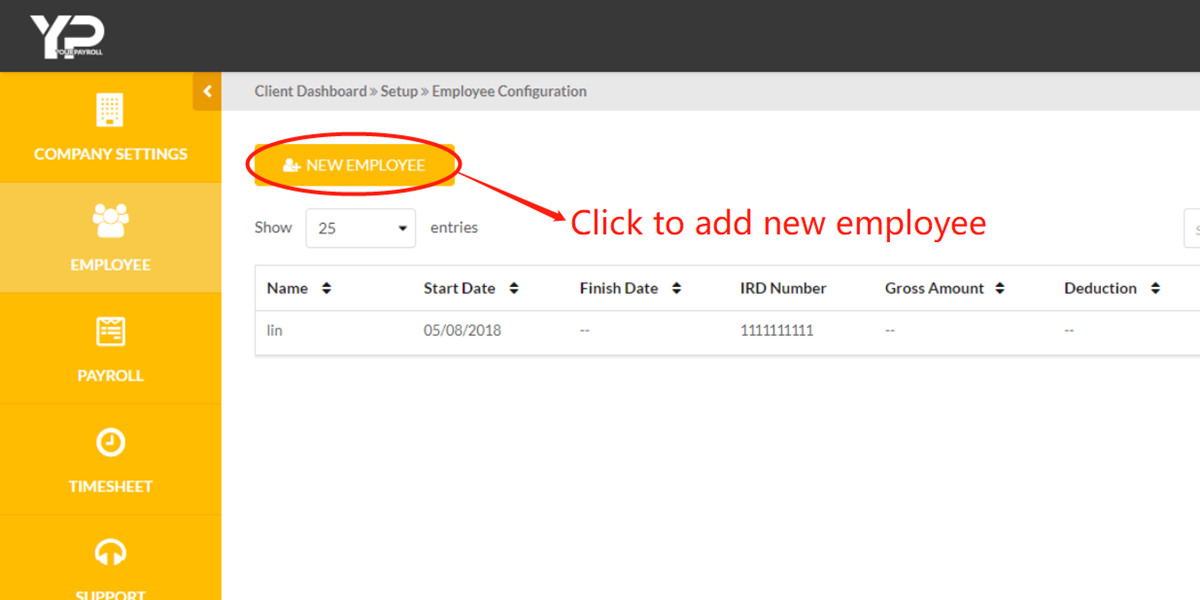

If you already have employees in the system,

click “New Employee” button to add new employees.

Step 3

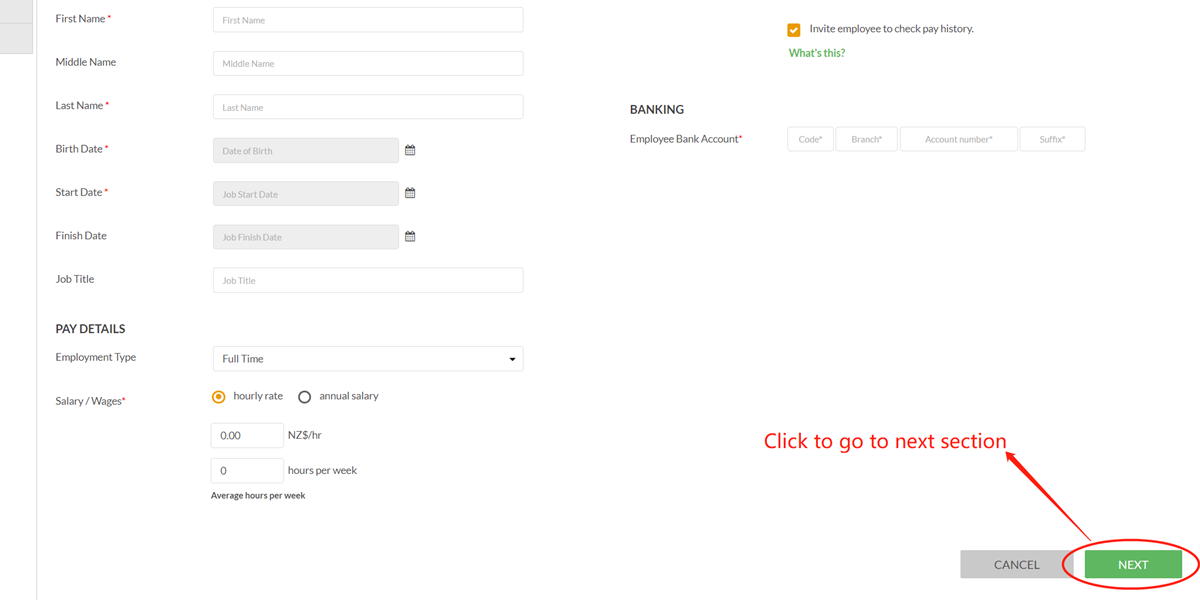

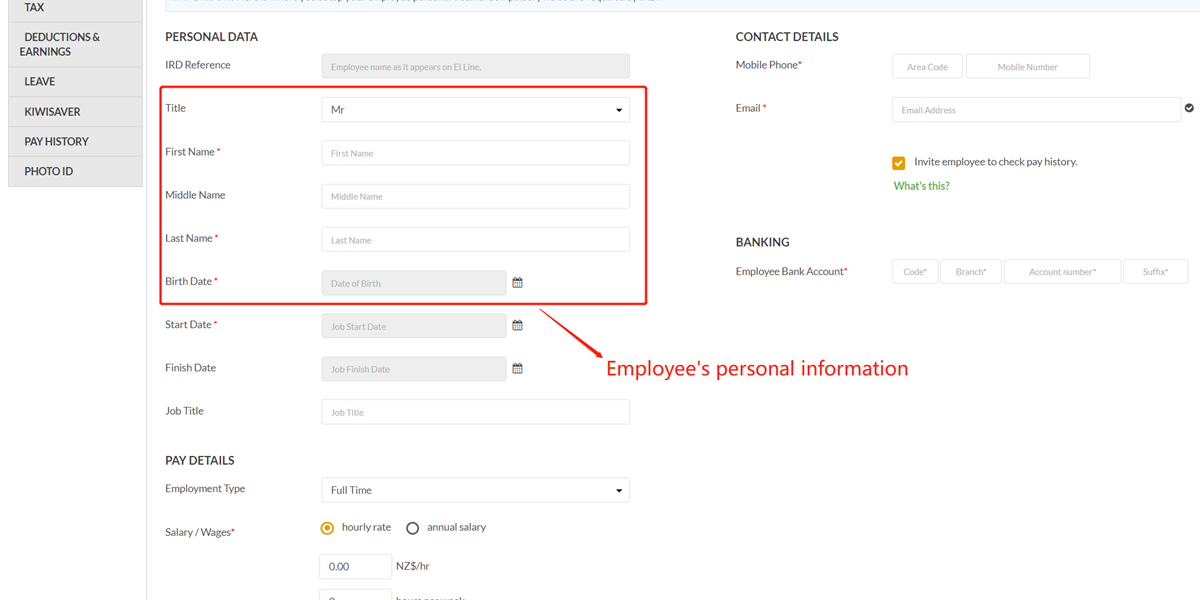

Then input employee's basic information.

Step 4

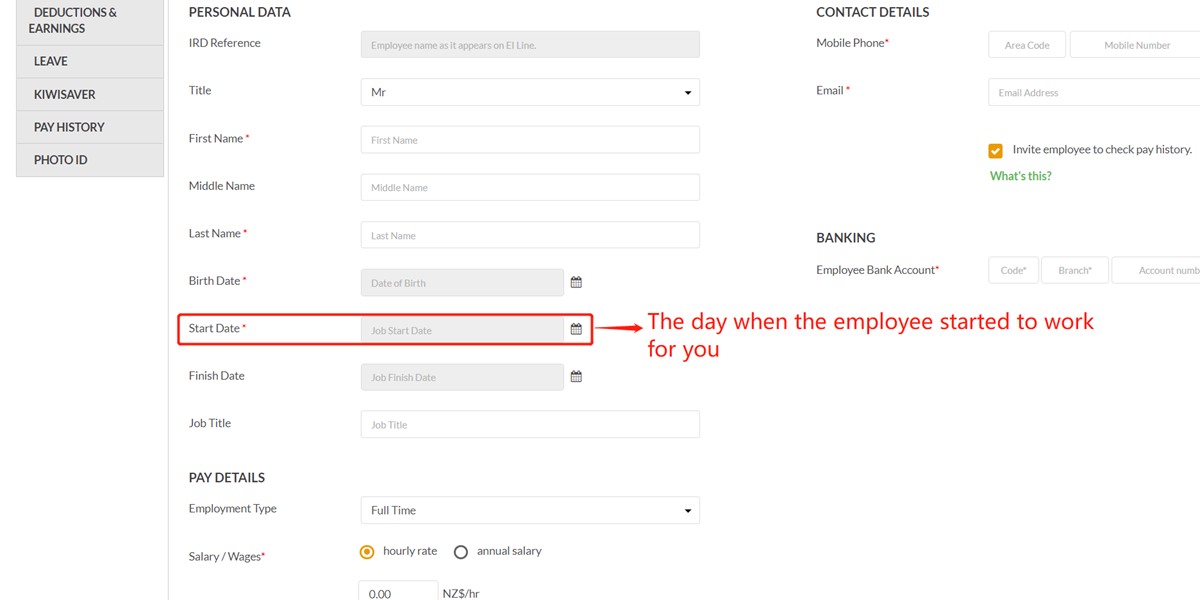

The “Start Date” is the day when the employee started to work for you.

Step 5

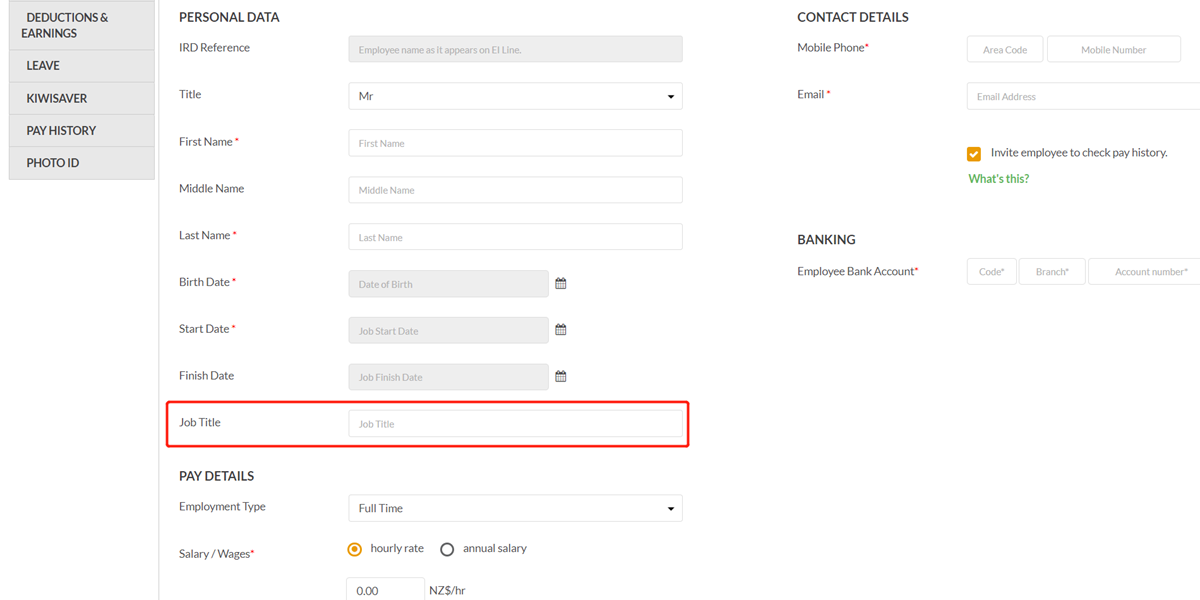

It is recommended to input employee’s job title.

It will show in the payslips.

Step 6

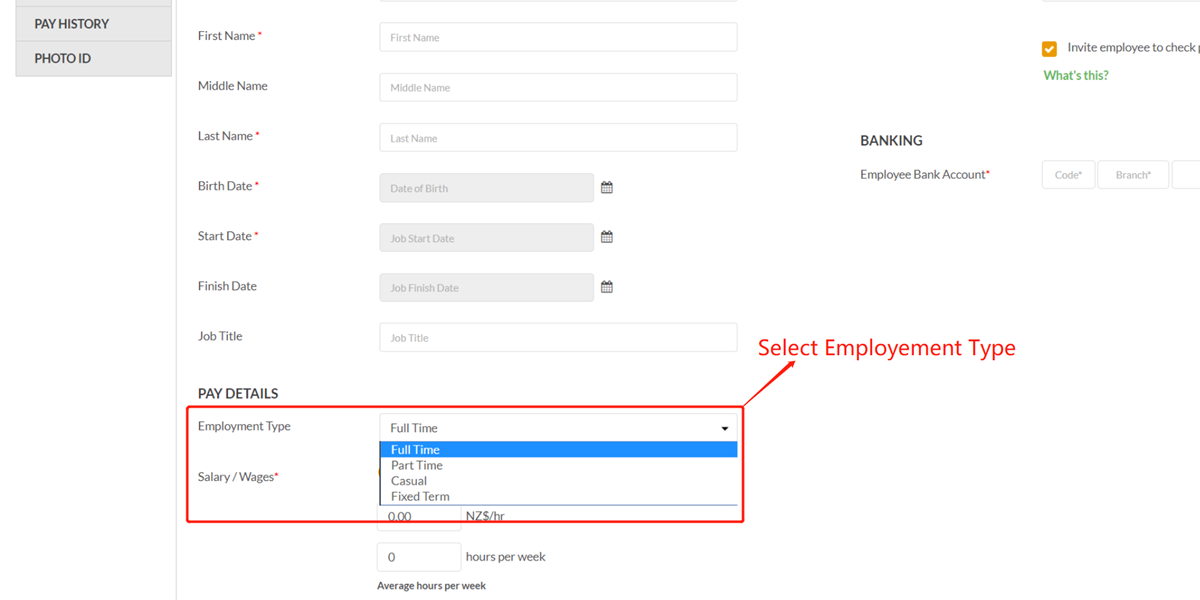

Select "Employment Type".

NOTE: This comes from your employment agreement. If you are not sure about this, consult with your employment lawyer.

Step 7

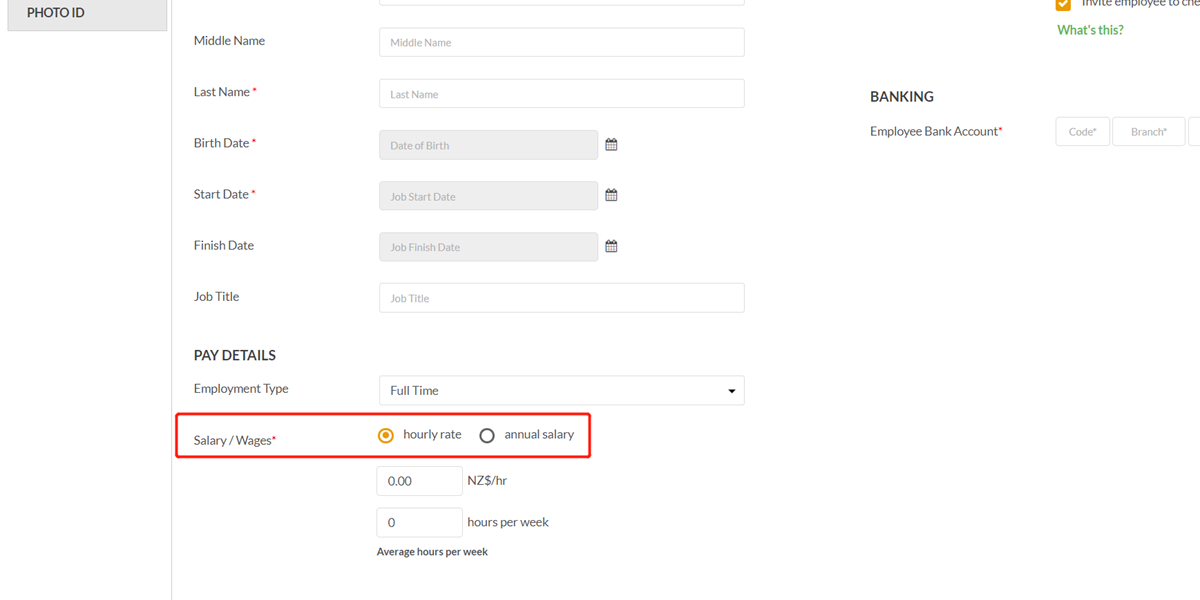

Choose salary rate type, it can be either:

a) Hourly Rate, or;

b) Annual Salary.

NOTE: If you are not sure, please check your employment contract.

Step 8

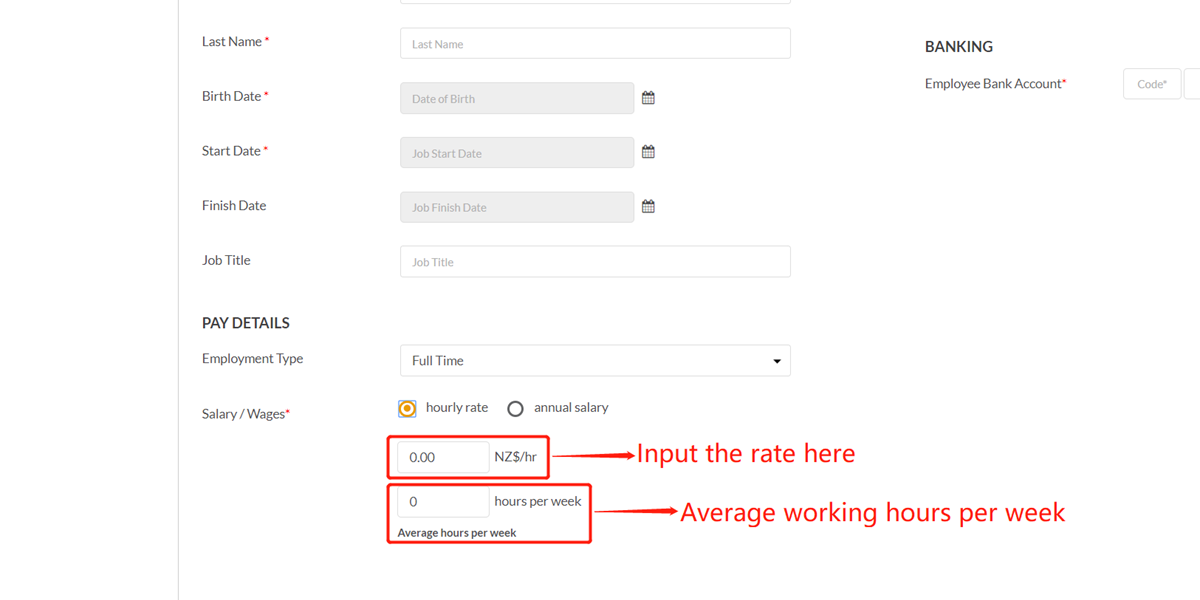

If it’s hourly rate, input the rate and average working hours per week.

NOTE: If you are not sure, please check your employment contract.

You can always change it later.

Step 9

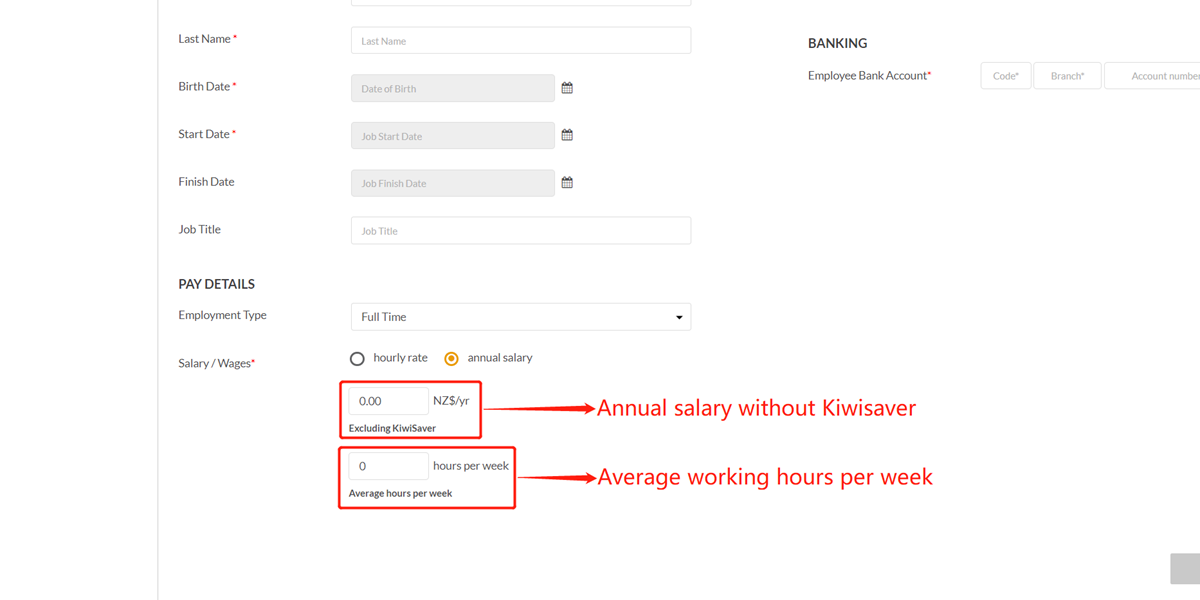

If it’s annual salary, input the salary amount without KiwiSaver, and average working hours per week.

Step 10

Please also input:

a) Their mobile and email address (Your employee will receive payslips via this email);

b) The bank account that your employee receives the salaries.