How to Set Up Employee | Add Pay History

Things to Know

-

If video learning is your style, please click on video and start to learn Set up Employee in Your Payroll (watch from 5' 39").

-

If step by step instruction is your style, then keep scrolling down.

Make sure you have following before start:

-

Employee's IRD Number;

-

Employee's Contact Details, including: mobile phone number and email;

-

Employee's Photo ID (Passport or NZ driver licence);

-

Tax Code Declaration Form: IR330 (For employee) ; IR330C (For contractor) ;

-

Student Loan Letter from IRD (if available).

Get Started

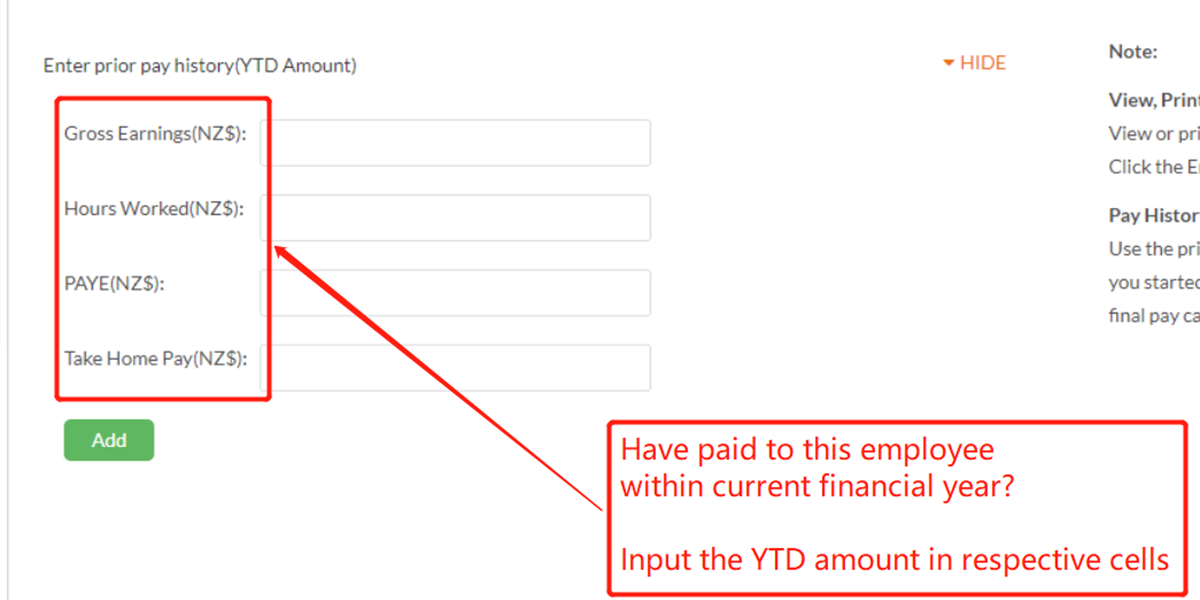

Have you paid salaries to this employee within current financial year?

If No, you can skip this section.

Step 2

Have you paid salaries to this employee within current financial year?

If Yes, please input the YTD amount in respective cells.

You can find these figures from your prior payroll software or from your accountant.

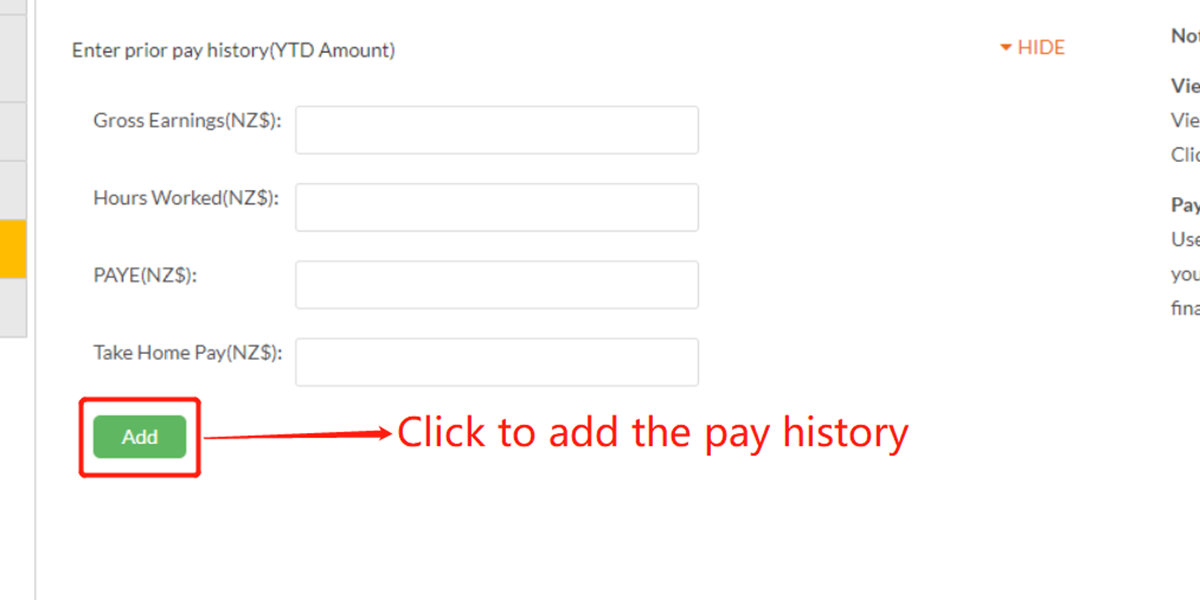

Step 3

Click “Add” button to add the pay history.

If unsure about this section, please consult with your accountant.