How to Set Up Employee | Additional Earnings

Things to Know

-

If video learning is your style, please click on video and start to learn Set up Employee in Your Payroll (watch from 1' 53").

-

If step by step instruction is your style, then keep scrolling down.

Make sure you have following before start:

-

Employee's IRD Number;

-

Employee's Contact Details, including: mobile phone number and email;

-

Employee's Photo ID (Passport or NZ driver licence);

-

Tax Code Declaration Form: IR330 (For employee) ; IR330C (For contractor) ;

-

Student Loan Letter from IRD (if available).

Get Started

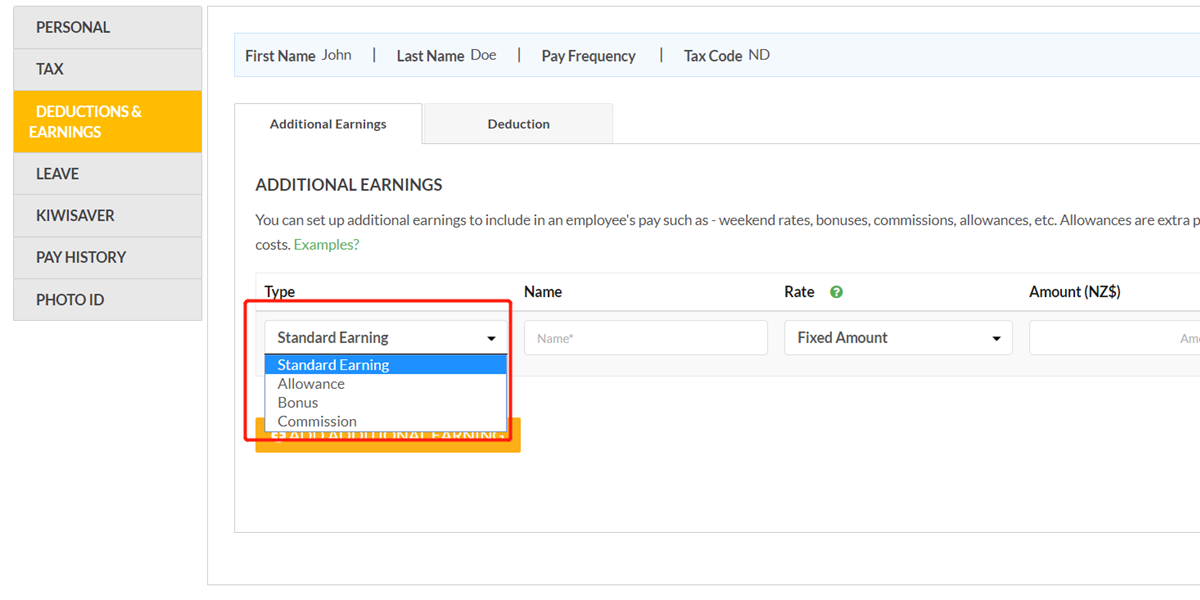

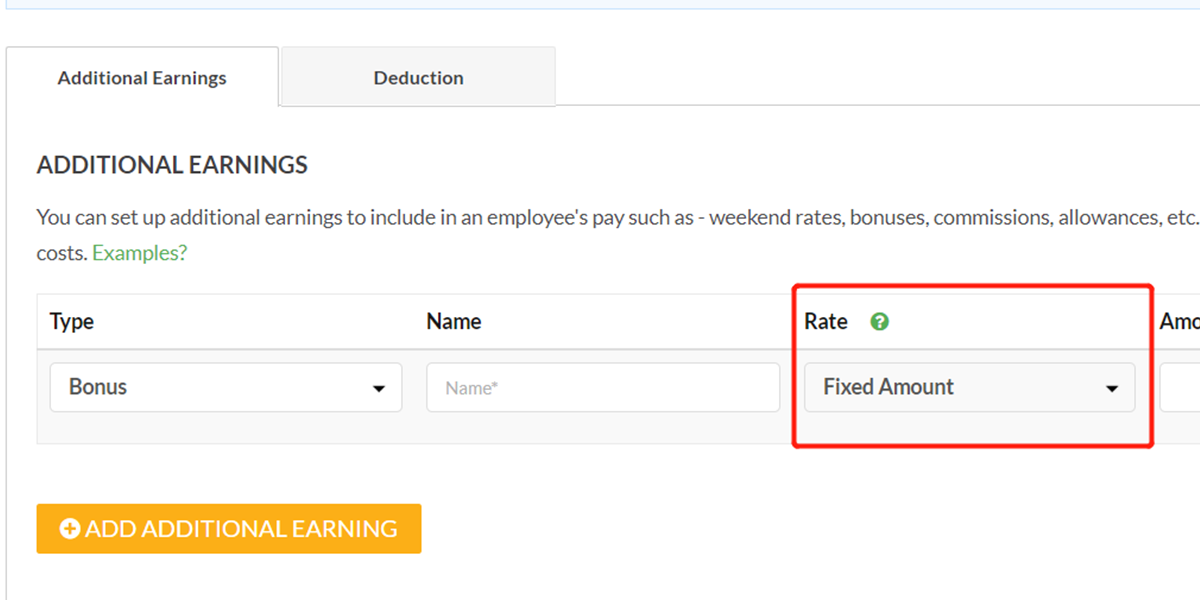

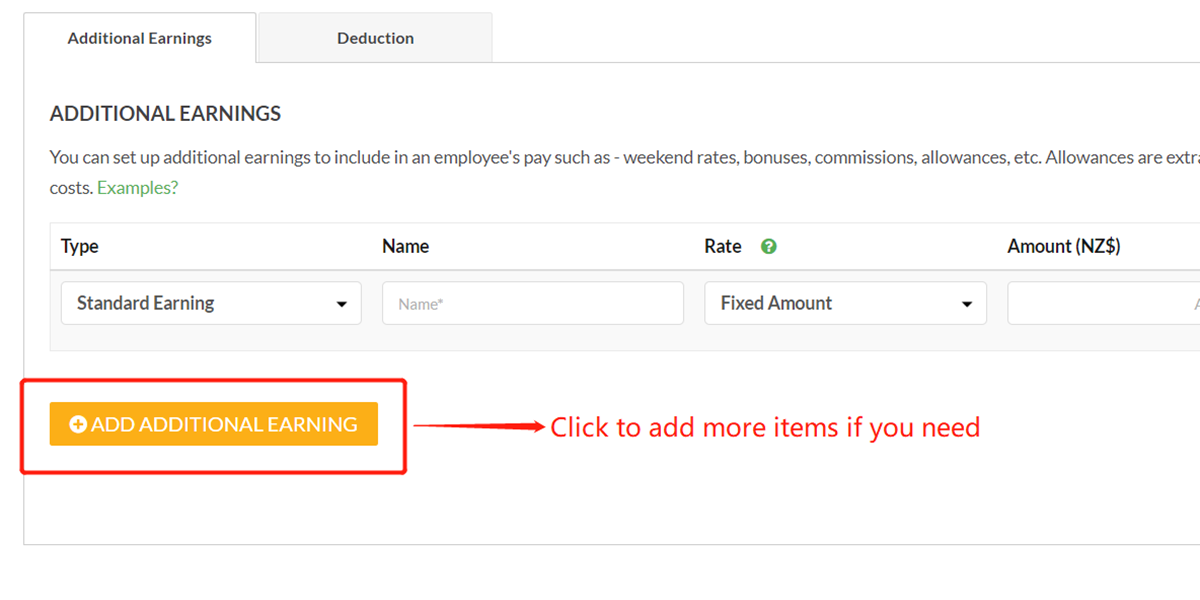

Select the type of your employee's additional earning.

Step 2

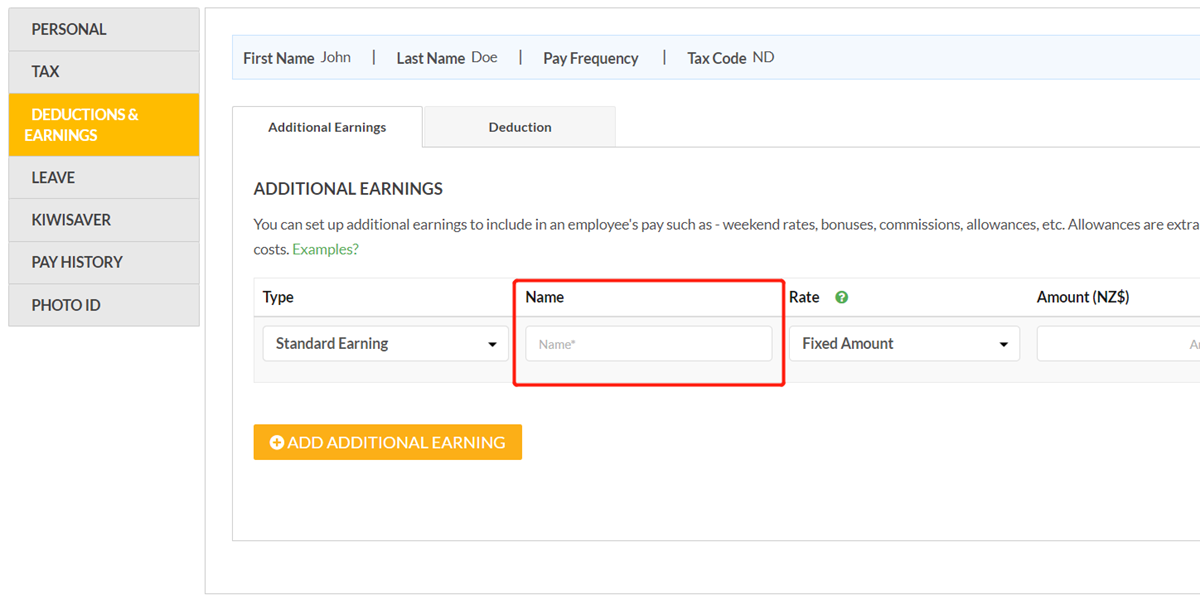

Give it a name so that you can clearly identify it.

Step 3

Select whether the additional earning is fixed amount or per hour rate.

Step 4

Please be noted that bonus can only be fixed amount.

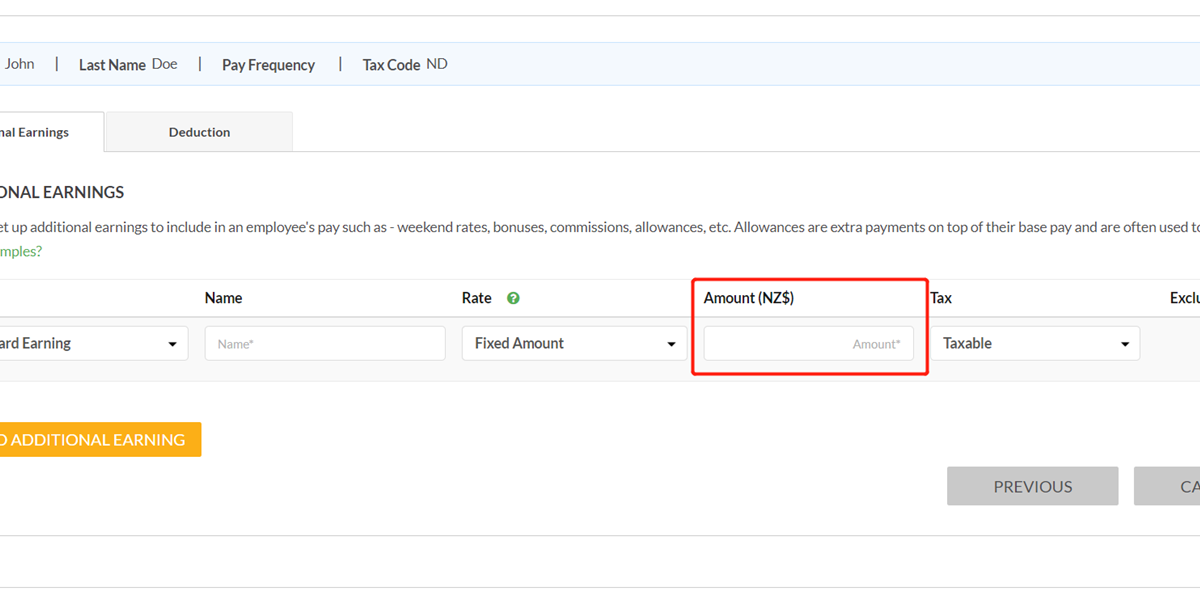

Step 5

Input the amount here.

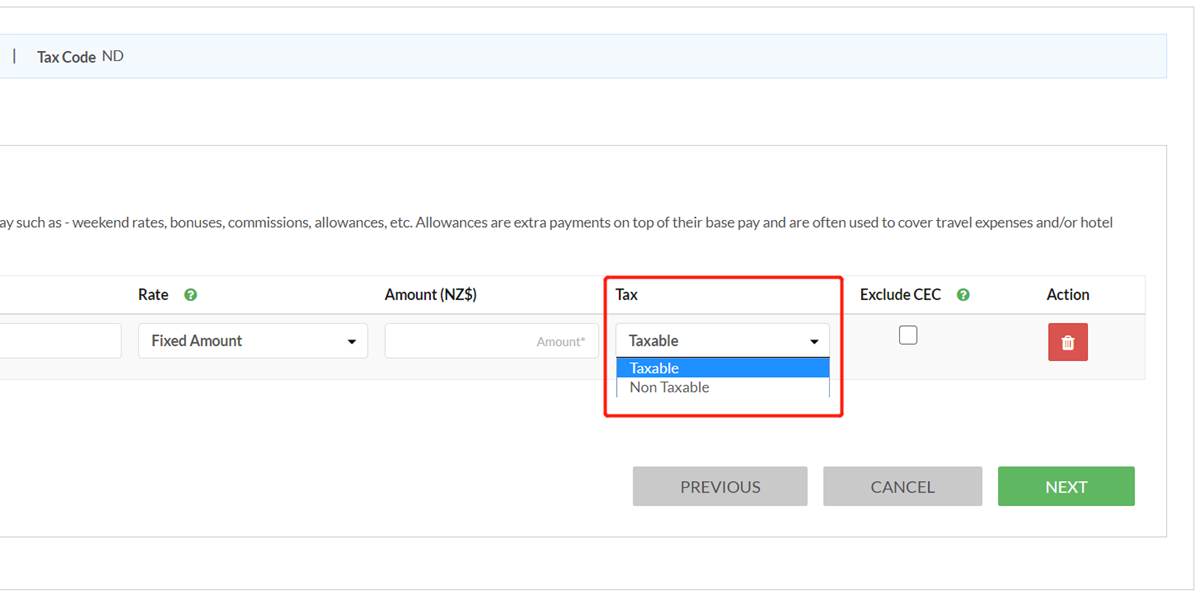

Step 6

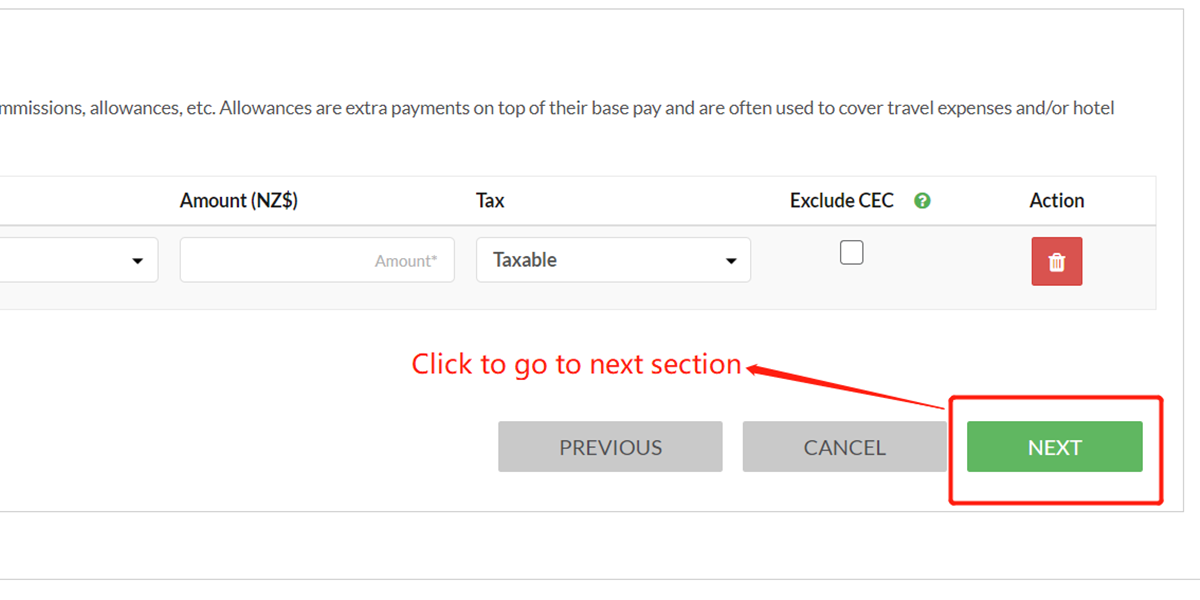

Choose it is either taxable or not taxable.

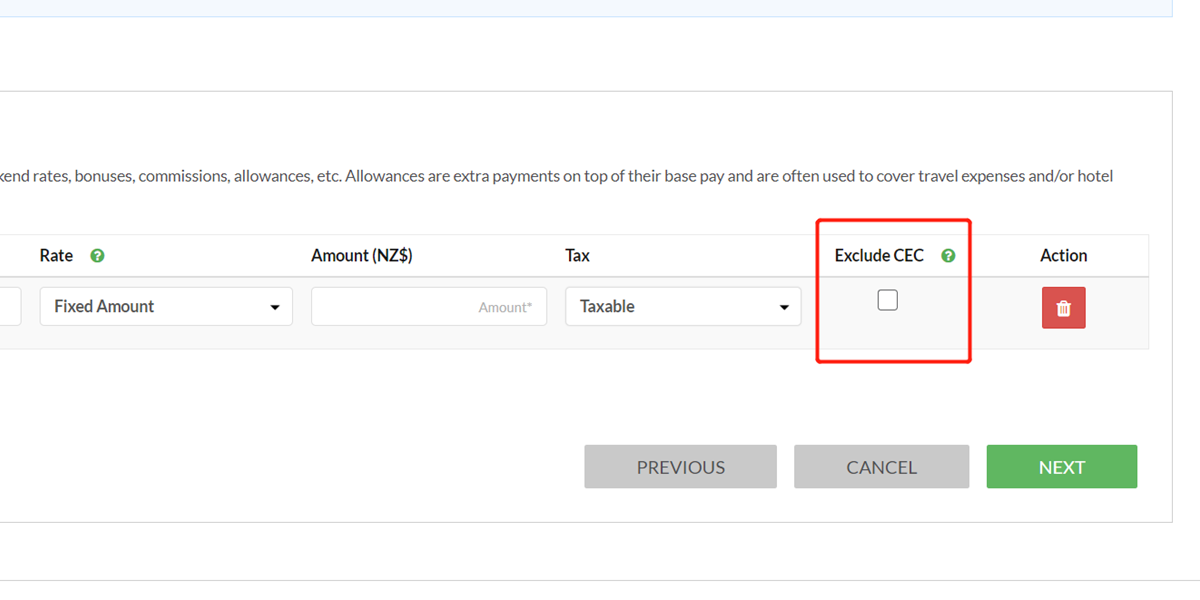

Step 7

Do you pay Kiwisaver for this amount?

-

If No, please check this box;

-

If Yes, please leave it blank.

Step 8

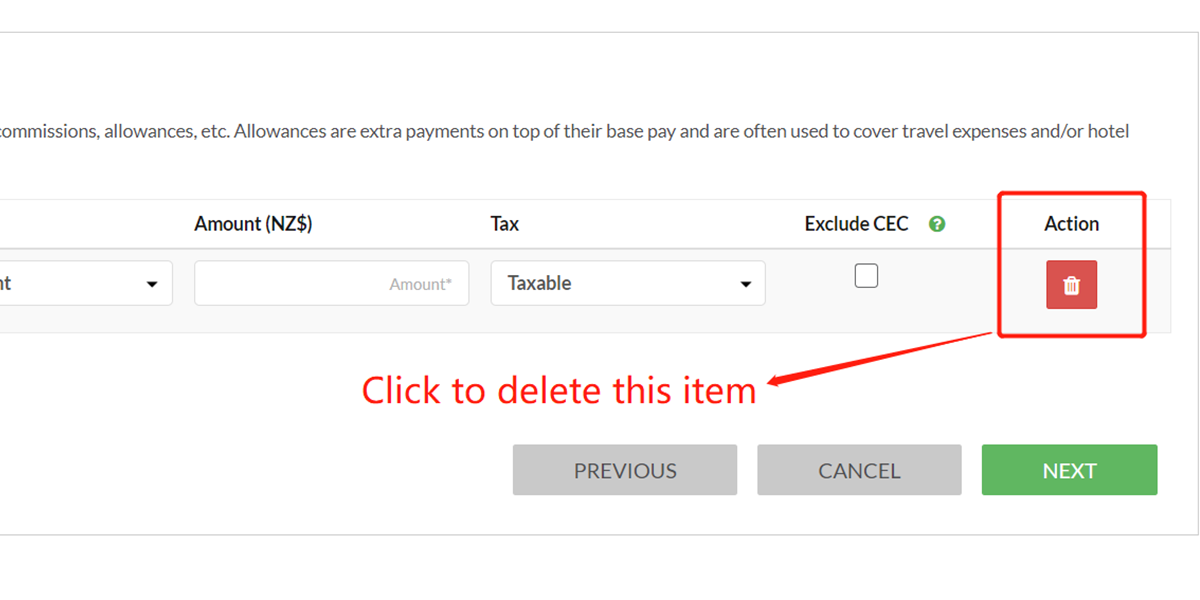

If you want to delete one item in this section, simply click the red button.

Step 9

Click here to add more items if you need.